Markets had a heavy end to last week and continued to give up ground at the start of this week. The MSCI All-World Global Equity Index returned to its March lows, and US indices gave bear signals.

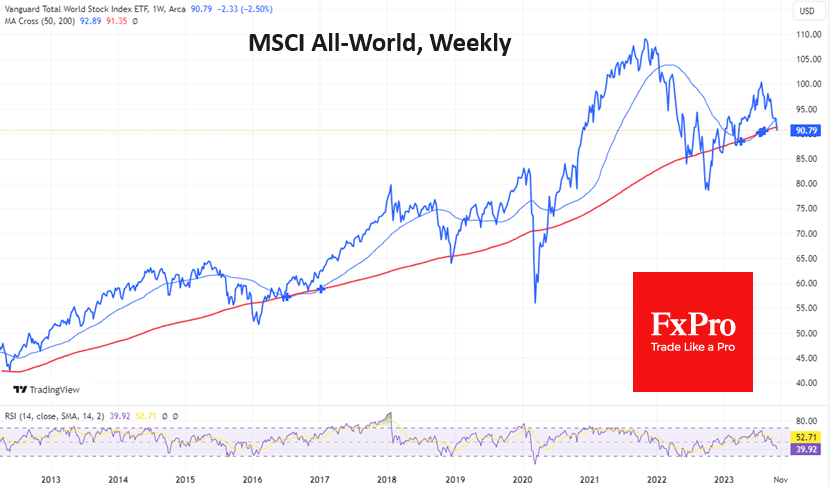

The index of global equities fell below the local lows of early October and May to its lowest level since March. The sell-off intensified when the index broke below its 200-day moving average. The last time global equities traded at such a low was at the height of the US regional banking crisis. At the start of the month, the last time the index fell below this curve, equities had accumulated significant oversold conditions. The bounce and subsequent consolidation allowed sellers to build liquidity for a new, sharper attack.

The weekly timeframe now shows a tug-of-war near the 200-week moving average. Over the past decade, a break below this line has accelerated the sell-off, with losses of 11% in September 2022, over 23% in March 2020 and around 9.5% in January 2016. This was the most dramatic but relatively short-lived phase. Less than a month later, we saw a sharp rebound. Will that happen this time?

The major US stock indices closed lower last week, sending an important signal of buyer weakness that could trigger a more substantial sell-off in the new week.

The S&P500 ended last week below its 200-day moving average and started the new week close to the October lows near 4200. After rallying to nearly 4400 in early October, the S&P500 temporarily recovered almost half of its losses since the sell-off began in August. However, it then encountered strong resistance in the form of the round level and the 50-day moving average.

Developing this Fibonacci pattern opens a 5% downside potential to 4000. Still, we also look to the 200-week average (now at 3945, or -6%), which could be a centre of gravity for the bears.

The Nasdaq100 is decisively looking for a bottom, having returned to 14500, where it stayed briefly in early October. Previously, we saw a sharp reversal to the downside as it approached the upper boundary of the descending range, confirming its strength.

Building on the pessimistic picture in the broader indices, we are preparing for an intensified sell-off in the Nasdaq100 with a potential target in the 13700-14000 area. The lower boundary is the pivot point from August last year, while the upper boundary is the 200-day average. A deeper target for the bears is seen in the 12700 area, where the 200-week average runs through.

The FxPro Analyst Team