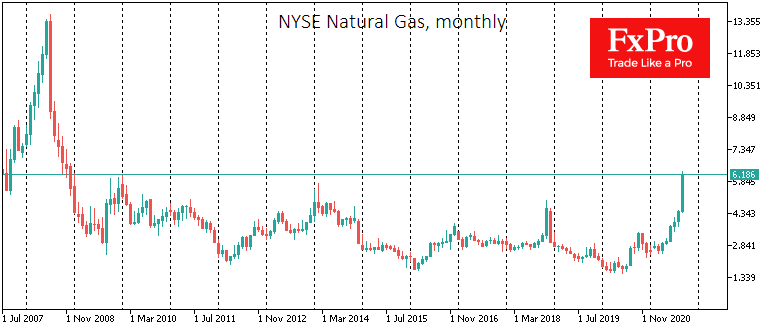

The primary focus on the markets switched to the energy sector, where prices are making new multi-year highs. The price of natural gas in the US on Tuesday morning was over $6.3 per MMBtu, the highest since 2008. The price of gas surpassed $1,000 per thousand cubic metres in European trading – a new psychological and historic high. Coal is now as expensive as it was 12 years ago. Brent futures have surpassed the $80 mark, while the spot market is only getting closer to that level.

While there are very tangible reasons behind this rise in energy prices, there is still plenty for long-term buyers to worry about. Stock markets have moved away from the ‘stocks only go up’ motto, and we see more signs of bears advancing on different fronts. Energy – has remained the last refuge of the bulls.

This kind of trend acceleration and price sweeping away everything in its path are often the final points in the trend.

Two of the most striking examples from recent history come to mind. The first such example was the similar spike of energy prices in 2008 when a barrel of Brent set an all-time high of $147, and then the wheel had turned. By then, equity markets had already been dominated by a ‘sell’ mood for many months.

Another example was dynamic in April 2020. At that time, oil prices continued their decline, rejecting the reversal of stock indices to growth. The final chord was struck at the monthly expiry of the WTI contracts in the US when prices temporarily went into negative territory, and Brent fell to $16, which was clearly below economically sound levels. That was a turning point.

That is not to say that oil prices are astronomically high right now. Much more worrying is the jump in gas and coal. The chances are high that the market will reach a breaking point in the coming weeks, with sharply lower coal and gas prices pulling oil with them.

From that perspective, potential technical targets near $100 per barrel Brent should not be taken as sustainable long-term targets. The world remains within artificial constraints on oil production. Rising prices and demand promise to push producers to increase production and investment in the industry, easing those constraints.

Moreover, high fossil fuel prices are the best driver for the payback of alternative energy projects. It is probably too early for investors and traders to bet on falling energy prices, but it is already worth bearing in mind that prices now seem to be detached from reality. Further, signs of falling demand for fossil fuels, which could well coincide with rising supply, are worth keeping an eye on. A shift in the balance of market forces could result in one of the most significant selloffs in the energy market in recent years.

The FxPro Analyst Team