Employment growth is somewhat weaker than expected, but wage growth and the falling unemployment rate could be a reason for another Fed rate hike.

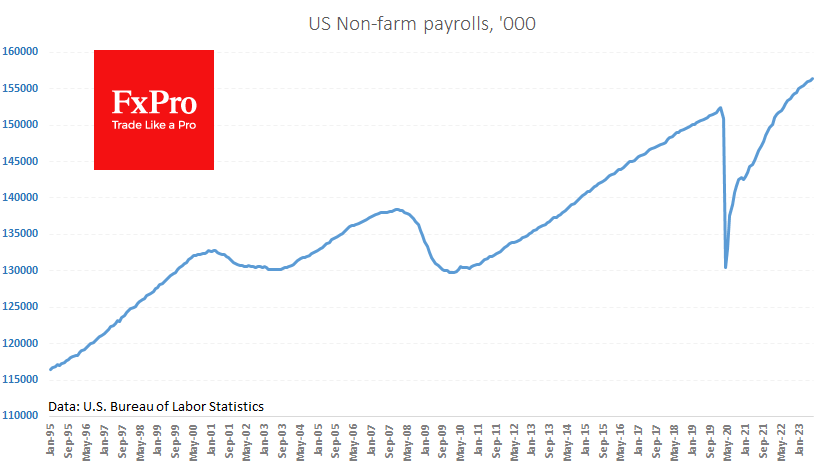

The US labour market created 187k new jobs after 185k previously (revised from 209k). Formally, the data is weaker than the expected 205k. Still, these differences are minor as NFP is one of the most unpredictable indicators, and such a difference is unlikely to trigger a significant reassessment of the markets.

Nevertheless, we note the return of the unemployment rate to 3.5%. This indicator is at a cyclical low, suggesting that inflationary pressures will persist, preventing the Fed from softening its rhetoric.

Also in favour is the more substantial than expected rise in hourly earnings. They rose 0.4% m/m, maintaining the 4.4% y/y pace that looks like the new normal since the start of the year.

At this wage and employment growth rate, one would expect inflation to fall on the back of falling commodity prices. However, the 20% rise in oil prices over the past six weeks makes such a scenario too illusory. Markets should brace themselves for the fact that the Fed still needs to do more tightening.

The FxPro Analyst Team