The Bank of England and the ECB will announce their monetary policy decisions today. They could reinforce the contrast in policy between these central banks and trigger a significant reassessment in the FX market.

The ECB is expected to confirm its plans to halt its emergency balance sheet buying programme in March. But it will keep the refinancing rate at zero and continue with ‘regular’ balance sheet purchases.

The ECB is likely to try to save face after yesterday’s new inflation record and show more hawkish rhetoric than we are used to. Even so, the eurozone will fall seriously behind the US and UK in its fight against inflation, which can dent the euro.

The Bank of England is expected to raise its rate for the second time in this cycle from 0.25% to 0.5%. And we would not be surprised if there are hints in the official comments of a willingness to raise the rate at every subsequent meeting in the coming quarters.

The overall situation could resemble the early 2000s when the Bank of England acted more aggressively than its Fed and ECB counterparts to suppress inflation.

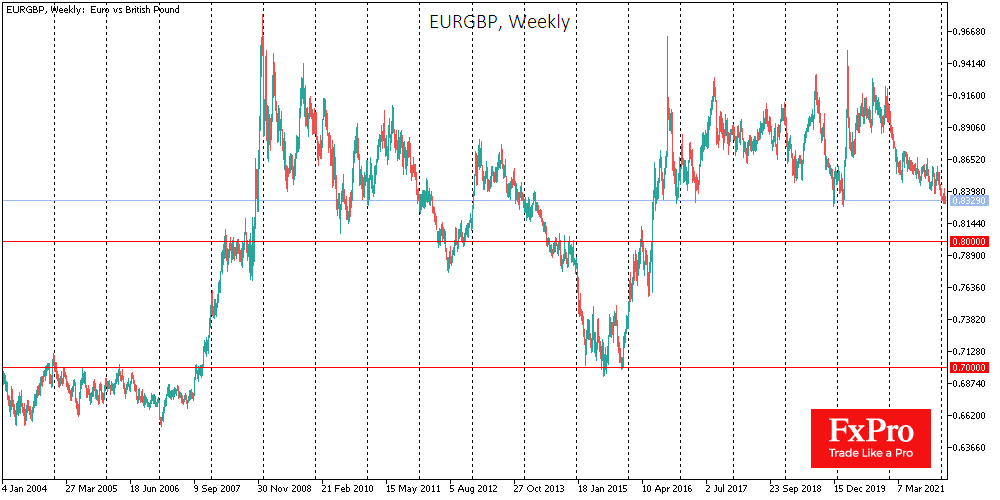

Tight monetary policy will provide the pound with a chance to get out of extreme lows where it found itself due to Brexit and the pandemic, consolidating this year in the 1.42-1.60 area in GBPUSD and a move into the 0.70-0.80 range for EURGBP.

The FxPro Analyst Team