Data out of the US pointed to a further build-up of pro-inflationary risks from the labour market, giving the Dollar a fresh boost intraday.

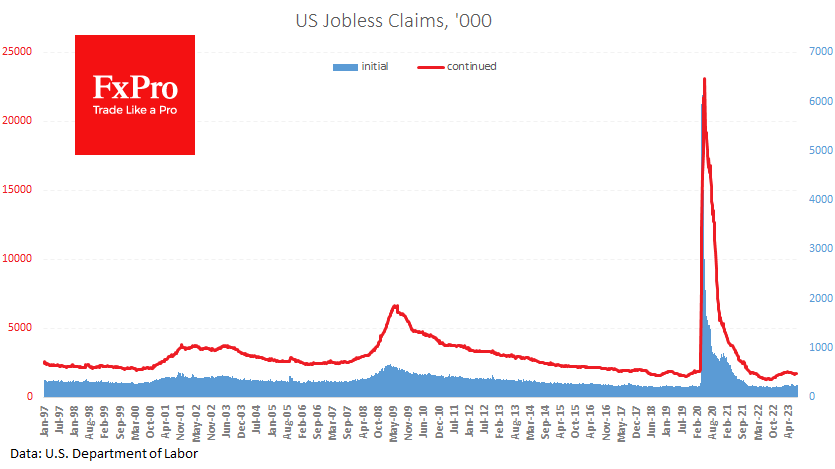

Fresh data showed weekly jobless claims fell to 230K, down from 240K and 250K in the previous two weeks. This is the lowest level since May. Initial jobless claims fell to 1,702K from 1,711K the previous week, remaining in a downtrend.

Futures markets are pricing in a 48% chance of a hike before November, the highest since early July. This repricing is working on the Dollar’s side, pushing short-term bond yields higher and raising the risk-free yield bar.

The other report, Durable Goods Orders, wasn’t very encouraging. Total orders fell 5.2%, almost wiping out the previous two months’ gains (+4.4% and 2.0%). Orders excluding transport, which adds volatility to the indicator, rose by 0.5%. By the same amount, new orders are now above the previous all-time high reached in the middle of last year. While the latter indicator was above analysts’ average forecasts, it indicates a barely vibrant economic expansion.

This combination of factors suggests that companies are reluctant to invest but are forced to hire and pay higher wages.

The FxPro Analyst Team