The Dow and broader U.S. stock market extended their relief rally on Tuesday, as investors awaited reassurance from the Federal Reserve that monetary policy will remain highly accommodative for the foreseeable future. All of Wall Street’s major indexes opened sharply higher, mirroring a bullish pre-market for U.S. stock futures. The Dow Jones Industrial Average rallied by as much as 235 points.

Tech heavyweights Apple and Microsoft were the Dow’s biggest gainers, followed by Boeing and Intel. The broad S&P 500 Index of large-cap stocks rose 1%, with ten of 11 primary sectors reporting gains. Energy, information technology, and communication services were the biggest gainers. Surging tech stocks pushed the Nasdaq Composite Index sharply higher. The benchmark rose 1.4% after the open. A measure of implied volatility known as the CBOE VIX continued lower on Tuesday. The so-called “investor fear index” declined more than 3% to 24.92 on a scale of 1-100, where 20 represents the historic average.

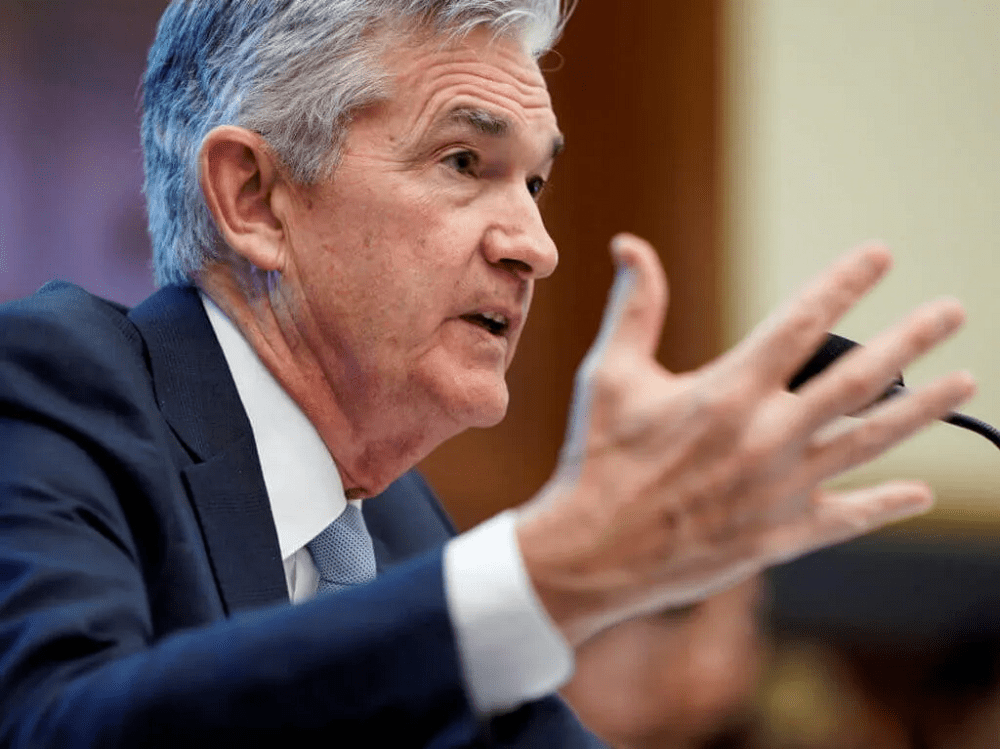

The Federal Reserve kicked off its two-day policy meeting on Tuesday, and the first since Chairman Jerome Powell announced a new strategy geared towards average inflation targeting. Watch the video below: Under the Fed’s new framework, policymakers will allow inflation to overshoot its 2% target in pursuit of other macroeconomic objectives. In other words, the central bank will keep interest rates at rock bottom for the foreseeable future.

The Federal Open Market Committee will deliver its policy statement Wednesday afternoon alongside its quarterly economic projections. No change in monetary policy is expected.

Dow’s Explosive Rally Continues As Fed Begins September Policy Meeting, CCN, Sep 15