Crude oil is down for a third consecutive day, having lost more than 2% earlier on Biden’s comments that the West might agree to buy Russian oil at a discount instead of an embargo.

In addition, the US media is reporting that Saudi Arabia will replace the oil that has left the market due to falling production in Russia. The Saudis officially deny such agreements. They also deny that they are willing to exclude Russia from the OPEC+ quota calculations as it cannot even come close to them.

We noted earlier in the week that news of a potential EU embargo on Russian oil was not accompanied by a logical rise in prices attributed to the “sell the facts” pattern.

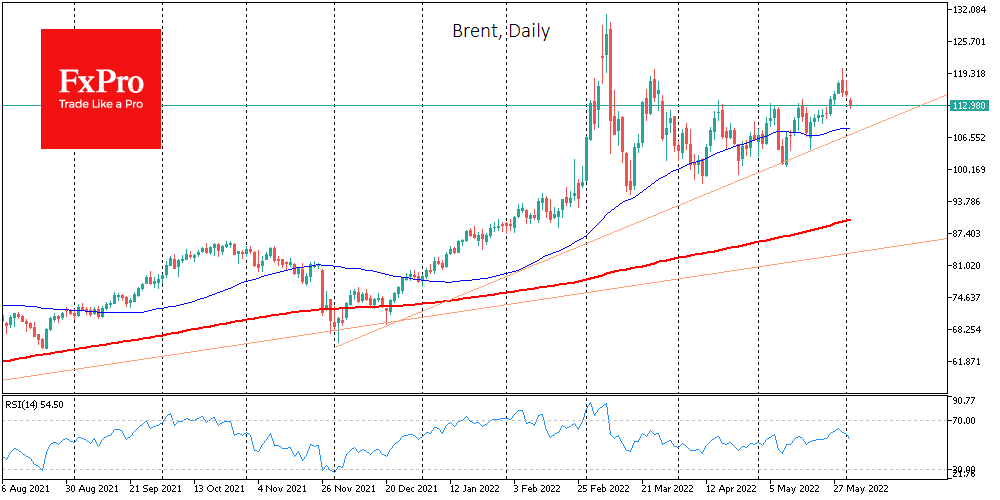

However, the latest news outlines the features of a new reality, where the oil supply might not quickly and directly suffer. And this is working to cool the price, which recently touched an area of extremes.

Separately, the strengthened pull into the dollar is locally playing against oil. Upbeat macro data is boosting market confidence in further rate hikes in 50-point increments, tightening the financial conditions to which oil is so responsive.

In our view, the bulls can no longer meaningfully push the price up. Positive news for oil is already priced in or has a limited impact in time and strength. Negative news, on the other hand, the market is working out very well.

Later today, US oil and gas inventory and production trends are worth looking at. If new data shows an increase in US production with moderate consumption, it could trigger a sell-off in oil. The opposite situation – stagnating production and rising inventories are unlikely to push the price to new levels.

This year has a risk of repeating the extreme performance we saw in 2014 when a flood of news about production growth in Saudi Arabia and the US and monetary policy tightening took more than 60% off oil in seven months. We may not yet be at a turning point, but it could be about a month or two away.

The FxPro Analyst Team