Although EURUSD had already fallen below the key historical level of 1.05 on Thursday, the weak PMI figures led to a further capitulation of buyers and a subsequent 1.5% fall in the single currency.

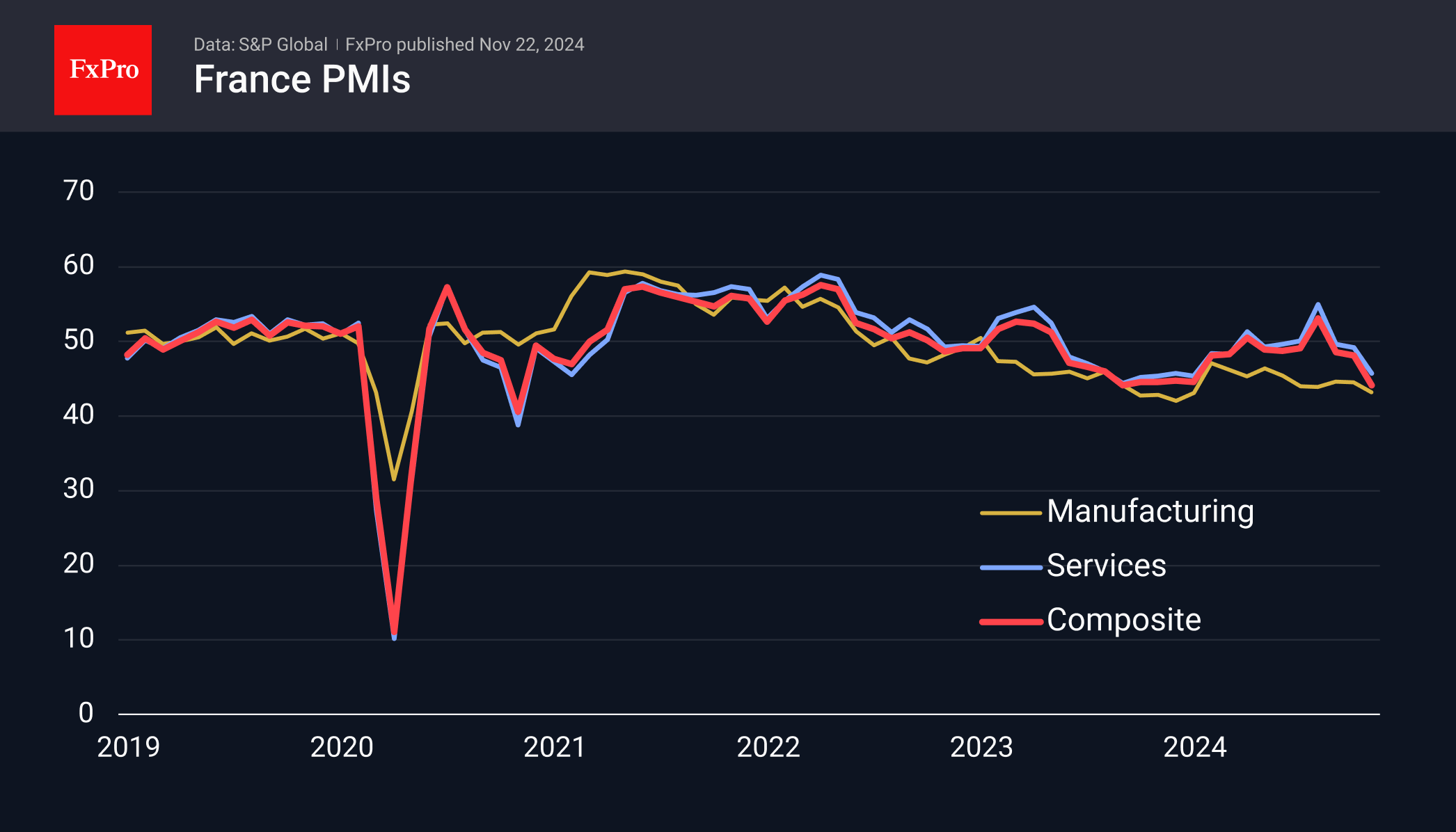

The sell-off was triggered by a sudden drop in the French manufacturing PMI from 44.5 to 43.2 (a slight rise to 44.6 was expected). An even bigger negative surprise came from the services sector, where the corresponding index fell from 49.2 to 45.7, indicating a shift from stagnation to recession. France’s composite PMI fell to lows seen at the start of the year: the Olympics effect was short-lived.

Germany’s manufacturing PMI rose from 43.0 to 43.2, a small positive that does not change the overall picture of a contraction in business activity. The indicator has been in contractionary territory since July 2022. The German services sector suddenly went into contraction and fell below 50 as the corresponding index fell from 51.6 to 49.4. At 47.3, the composite index reached its lowest level since February.

Preliminary PMI estimates for the entire euro area were also disappointing. The manufacturing PMI fell from 46.0 to 45.2 and has now been in contractionary territory for 29 months. The services activity index fell from 51.6 to 49.2 (the lowest since January) despite expectations for a reading of 51.6.

The EURUSD, which fell well below the key 1.05 level, forced more traders to capitulate on the back of the weak PMIs. EURUSD’s slide took the pair as low as 1.0330 (-1.5% in about an hour), a two-year low. By the start of the US session, EURUSD had bounced 0.9% off the lows to 1.0430, but staying below the 1.05 level puts it at risk of failing as it did in 2022 with a low just above 0.95, and in 1999 with a low just above 0.82 reached in 2000.

The FxPro Analyst Team