The Dow Jones Industrial Average dipped on Tuesday after the market scored its best session in six weeks a day earlier on rising optimism about a coronavirus vaccine. The 30-stock Dow traded 80 points lower, or 0.3%. The S&P 500 rose less than 0.1%. The Nasdaq Composite outperformed, rising 0.6%.

Home Depot shares lost 2.8% to lead the Dow lower after the home improvement retailer said net income last quarter dropped 10.7% due to extra costs related to the pandemic. Although the retailer also said sales increased by 7% for the period. Walmart shares dipped 0.2% despite soaring e-commerce sales in the first quarter.

Gains from Facebook, Apple and Amazon lifted the tech-heavy Nasdaq. Facebook and Apple both rose more than 0.8%. Amazon shares traded 2.2% higher. Investors turned their attention to Washington as Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell testified before the Senate Banking Committee. Their testimony is part of required updates to Congress on the economic response to the coronavirus pandemic.

Mnuchin said the government is “fully prepared to take losses” on coronavirus business bailouts. That testimony comes after Powell told CBS’ “60 Minutes” the central bank still has plenty of ammunition to support the economy.

Despite all this, “it’s still very tough from a fundamental perspective for anyone to get incredibly bullish,” said Yousef Abbasi, director of U.S. institutional equities at INTL FCStone. “If we get more data and cities start to reopen … then I would anticipate more confidence among investors.”

Data compiled by Johns Hopkins University shows more than 4.8 million cases have been confirmed worldwide, with over 1.5 million of those infections in the U.S. alone.

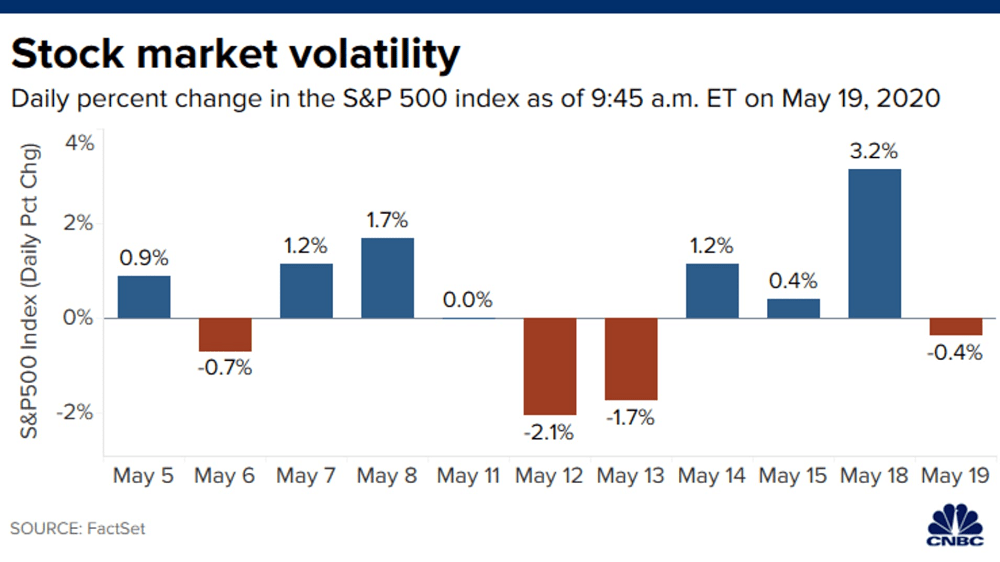

Tuesday’s muted action followed a strong rally on Wall Street that saw the Dow and S&P 500 both enjoying their biggest one-day gains since April 6. Investors cheered news that an experimental coronavirus vaccine from Moderna showed promising early signs. The 30-stock Dow jumped more than 900 points, while the S&P 500 closed the day up 3.2%, hitting its highest level since March 6.

With Monday’s gains, the S&P 500 has rebounded 32% from its March 23 low, now sitting about 13% below its record high in February. Monday’s rally also led the S&P 500 to close at its highest level since March 6.

Dow slips after Monday’s 900-point surge, Home Depot falls on earnings, CNBC, May 19