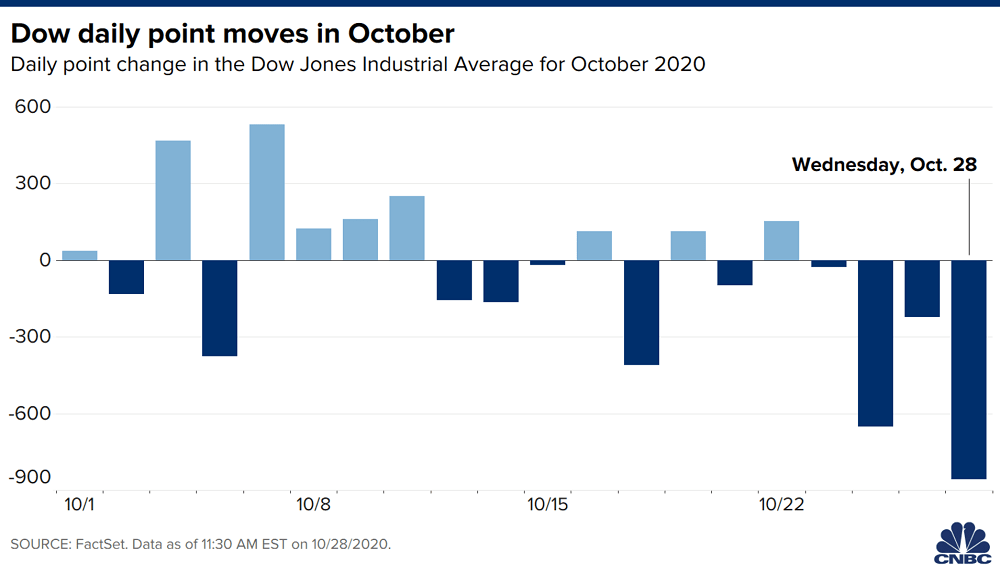

U.S. stocks fell sharply on Wednesday, following their European counterparts, as investors worried that the latest increase in coronavirus infections could halt the global economic recovery. The Dow Jones Industrial Average dropped 684 points, or 2.5%. Earlier in the day, the Dow was down more than 800 points. The S&P 500 dipped 2.5% and the Nasdaq Composite traded 2.8% lower.

In Europe, the German Dax index dropped 4.1% to its lowest level since late May and the French CAC 40 slid 3.4%. The FTSE 100 in London fell 2.7%. The recent uptick in Covid cases has led some countries to reinstate certain social distancing measures. German Chancellor Angela Merkel called on Wednesday for a limited lockdown. Meanwhile, Reuters reported, citing sources, that France was poised to issue a stay-at-home order. In the U.S., the state of Illinois has ordered Chicago to shut down indoor dining.

U.S. coronavirus cases have risen by a record daily average of 71,832 over the past week, data compiled by Johns Hopkins University showed. Meanwhile, coronavirus-related hospitalizations are up 5% or more in three dozen states, according to data from the Covid Tracking Project.

Stocks that would be hurt most by lockdowns or a slowdown in the economy reopening were hit. Shares of Delta Air Lines fell 6.2%. Royal Caribbean shares lost 5.8%. Shares of Facebook, Alphabet and Twitter were also down sharply as their respective CEOs testified in front of Senate members. Facebook and Twitter were off by 4% and 3.7%, respectively, and Alphabet slid nearly 5%.

Investors turned to bonds in their search for safety. The 10-year Treasury note yield fell to 0.75%. The Cboe Volatility Index (VIX), known on Wall Street as the market’s “fear gauge,” jumped above 40 and hit its highest level since June 15.

Dow sinks 680 points as investors fear rise in coronavirus cases could halt the economic recovery, CNBC, Oct 28