U.S. stocks climbed in volatile trading on Wednesday, paring the steep losses in September.

The Dow Jones Industrial Average last traded up 260 points, or 0.9%, after jumping 550 points at its session high. The S&P 500 gained 0.6%, while the tech-heavy Nasdaq Composite climbed 0.7%. Treasury Secretary Steven Mnuchin struck an optimistic tone about reaching a coronavirus aid deal on Wednesday after the stalemate in Washington dragged on for weeks.

However, Majority Leader Mitch McConnell said Wednesday afternoon that Republicans and Democrats are still “far apart” on a relief deal. Stocks cut gains after his comments.

The advance also came on the back of better-than-expected economic data. ADP’s monthly private-sector jobs count showed growth of 749,000 in September, ahead of the 600,000 expected from a Dow Jones economist survey. Meanwhile, pending home sales soared 8.8% in August, marking its highest pace on record, according to the National Association of Realtors survey.

Stocks sensitive to the economic recovery, including airlines, banks and cruise operators, led the market rally on Wednesday. Shares of American Airlines and United climbed more than 2.5% each, while Boeing also rose 2.1%. JPMorgan, Goldman Sachs and Citigroup all gained at least 1%. Norwegian Cruise popped more than 5%.

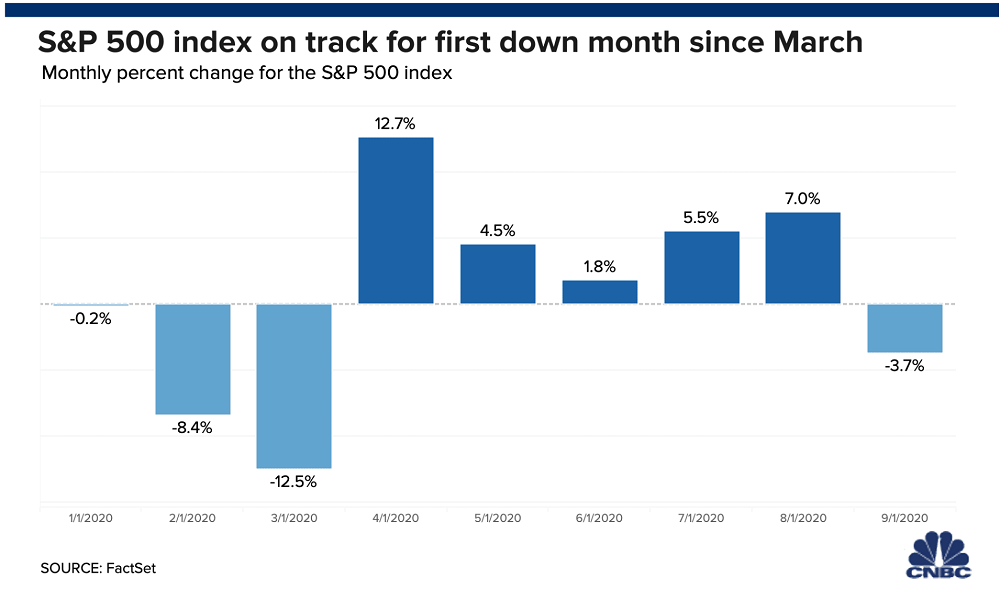

Still, major averages are headed for their first monthly declines since March. The S&P 500 is down more than 3% this month, on pace for its first down month in six. The Dow and the Nasdaq Composite have fallen 2.3% and 4.7%, respectively, in September.

Trump and Biden sparred on a number of issues, including their qualifications to manage the U.S. economy, the nomination of Amy Coney Barrett to the Supreme Court, as well as the U.S.′ handling of the coronavirus pandemic.

Many market strategists have cited uncertainty around the election as a key headwind for the market before year-end with each outcome bringing its own risks and benefits. Some investors have raised concerns about a potential Biden win as they fear it could lead to higher corporate taxes and tighter regulations. But at the same time, it could ease concerns about the trade war and lack of stimulus to bolster the economy in the wake of the coronavirus.

Investors are also worried about the potential that the Nov. 3 result is too close to call and neither candidate concedes. That uncertainty could particularly weigh on the market.

Dow rises more than 350 points, cutting September’s losses, CNBC, Sep 30