Stocks rose slightly on Friday as traders pored through the latest U.S. jobs report, putting the major averages on pace for another weekly advance. The Dow Jones Industrial Average traded higher by 150 points, or 0.5%. The S&P 500 gained 0.6% to hit a fresh all-time high, and the Nasdaq Composite advanced 0.4%. Chevron and Caterpillar rose more than 2% each to lead the Dow higher. Energy was the best-performing S&P 500 sector, gaining 3.7%.

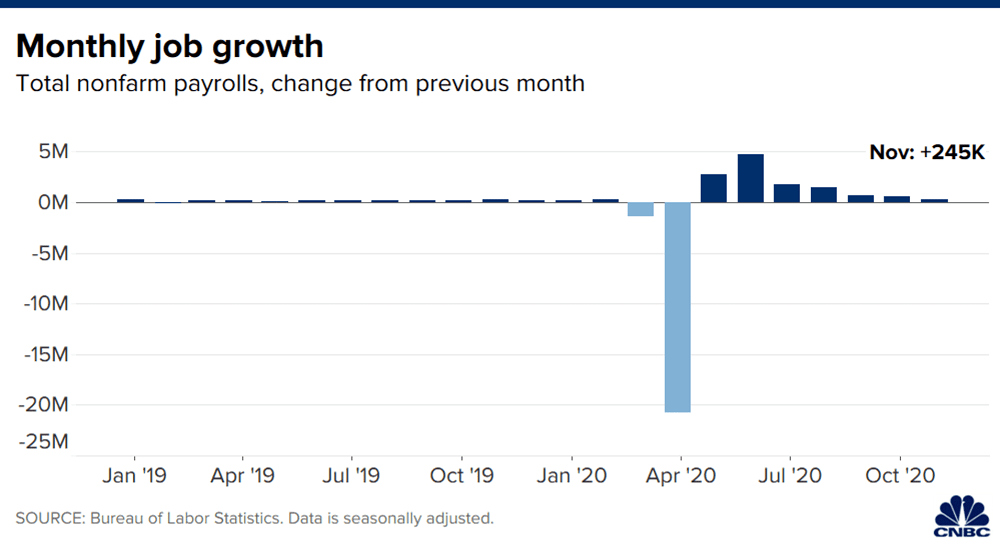

The U.S. economy added 245,000 jobs in November. That’s well below a Dow Jones consensus estimate of 440,000. The unemployment rate, however, matched expectations by falling to 6.7% from 6.9%. However, some traders saw the weaker-than-expected number as a positive because it could pressure lawmakers to mover forward with additional fiscal stimulus.

Friday’s jobs report data “is beckoning lawmakers to act on additional fiscal stimulus measures in order to bridge the output gap in the economy until a vaccine is deployed and the longer they hold out the wider the gap may become,” said Charlie Ripley, senior investment strategist at Allianz Investment Management. Senate minority leader Chuck Schumer tweeted the report “report shows the need for strong, urgent emergency relief is more important than ever.”

Friday’s report comes as the number of coronavirus cases has been rising sharply. The U.S. reported record numbers on Thursday of new infections, single-day deaths and hospitalizations. On Thursday, the stock market was hit by a report suggesting troubles with Pfizer’s coronavirus vaccine rollout. Major averages swiftly fell to their session lows after Dow Jones reported said Pfizer expects to ship half of the Covid-19 vaccines it originally planned for this year due to supply-chain problems. Still, Pfizer and BioNtech are on track to roll out 1.3 billion vaccines in 2021 and the 50 million dose shortfall this year will be covered as production ramps up, the report said.

Dow rises 150 points, S&P 500 hits fresh record high despite disappointing U.S. jobs report, CNBC, Dec 4