Stocks ripped higher on Wednesday as tech shares clawed back some of the steep losses that pushed the Nasdaq Composite into correction territory. The Dow Jones Industrial Average traded 450 points higher, or 1.6%. The S&P 500 jumped 2% and the Nasdaq Composite advanced 2.5%. Shares of Tesla, which had their single worst day ever on Tuesday dropping 21%, rose 7.3% Wednesday. Apple, which lost more than 6% in the previous session, was up by 4.4%.

Those two stocks, along with Microsoft, Netflix, Amazon, Alphabet and Facebook, lost $1 trillion in market value the last three days. All six were rebounding Wednesday. “The megacap Tech stocks are no longer invincible,” Tom Lee, head of research at Fundstrat Global Advisors, wrote in a note. “The bludgeoning seen in the last few days resulted in sharp pullbacks for these stocks.”

But investors, including CNBC’s Jim Cramer, believed it could be time to start cautiously nibbling at some stocks. The moves Wednesday came as investors shrugged off a setback with a coronavirus vaccine and disappointing earnings news. AstraZeneca shares fell 1.6% after the company said a late-stage trial of its Covid-19 vaccine candidate has been put on hold due to a suspected serious adverse reaction in a participant in the U.K.

The sell-off in technology shares worsened on Tuesday as investors rotated out of companies that led the market’s historic comeback from the coronavirus recession. That drop pushed the tech-heavy Nasdaq down more than 10% from its record high and into correction territory.

Many on Wall Street believe the technology weakness derived from worries that the massive tech run-up pushed valuations to unsustainable levels. Even with last week’s pullback, the Nasdaq is up more than 60% from its March bottom.

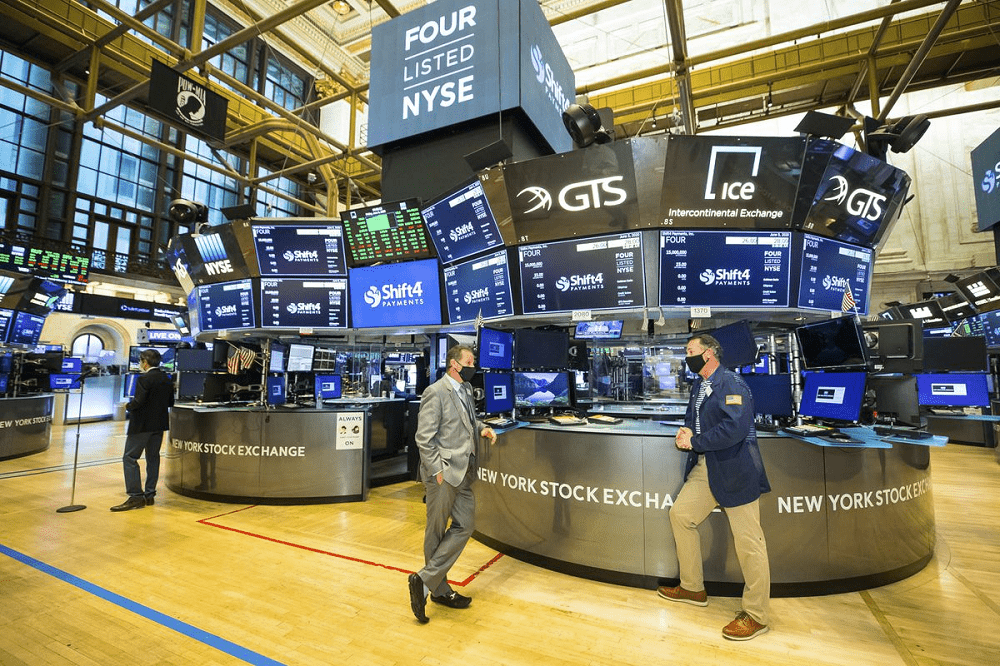

Dow rallies 450 points as tech recovers from massive sell-off, Apple up 4%, CNBC, Sep 9