Stocks fell sharply on Monday as fears about the worsening coronavirus as well as uncertainty on further fiscal stimulus rattled traders. The Dow Jones Industrial Average dropped 804 points, or 2.9%. The S&P 500 lost 2.6% while the Nasdaq Composite fell 2.3%. Monday’s decline put the Dow on pace for its worst day since June 11, when it plunged more than 6%. The S&P 500 was headed for its biggest one-day sell-off since Sept. 8. The major stock averages were all coming off their third consecutive losing week.

“It seems like the biggest reason for the decline in most global stock markets is the concern that tighter virus restrictions in Europe will result from the new spike in Covid cases now that the colder weather is upon us,” Matt Maley, chief market strategist at Miller Tabak, said in a note on Monday.

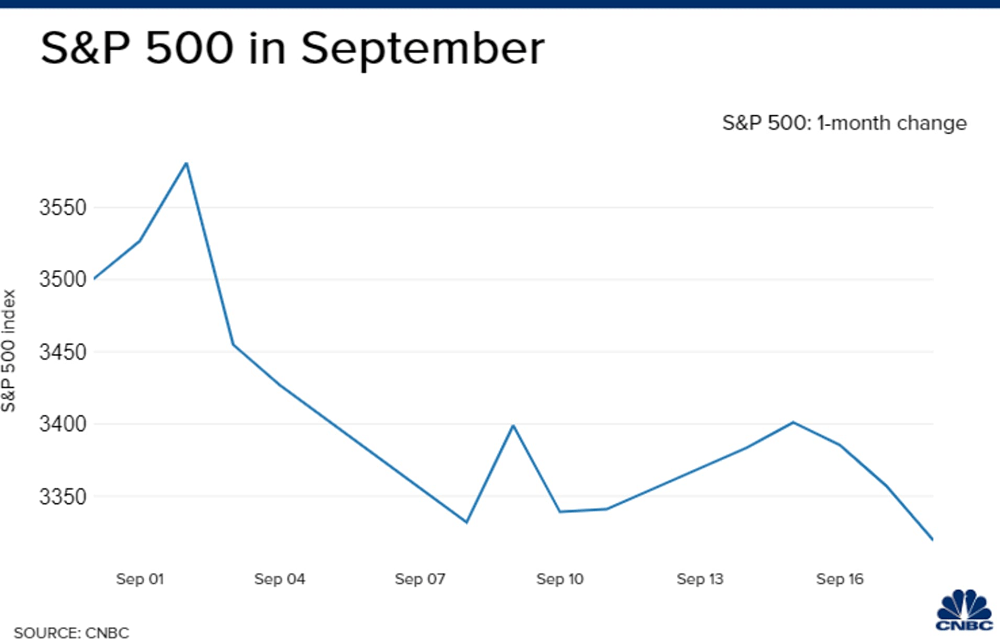

The S&P 500, Dow Jones Industrial Average and Nasdaq Composite all fell for a third straight week last week. That marks the market’s longest weekly slide since 2019. Facebook, Amazon, Apple, Netflix, Google-parent Alphabet and Microsoft all posted steep weekly losses. The tech-heavy Nasdaq Composite is in correction territory, down more than 10% from its recent record high. It’s been a rough month so far for the market and technology shares. The S&P 500 is off 5% so far in September.

Tech is coming under pressure in part on valuation concerns within the space as well as options of individual stocks, ETFs and indexes expired. “For the market to hold these levels buyers have to come into the technology sector over the next week to 10 days,” said Marc Chaikin, CEO of Chaikin Analytics, in a post. “Without the impetus of the call option buyers who helped propel the large-cap tech stocks to extreme valuations, it is unlikely that the subsequent rally can exceed the September peak.”

Dow plunges 900 points as September sell-off continues, CNBC, Sep 21