Futures tied to major U.S. equity benchmarks rose in overnight trading on Thursday as Wall Street attempts to build on its record-breaking rally. The Dow Jones Industrial Average futures gained 211 points. The S&P 500 futures and the Nasdaq 100 futures also traded in positive territory.

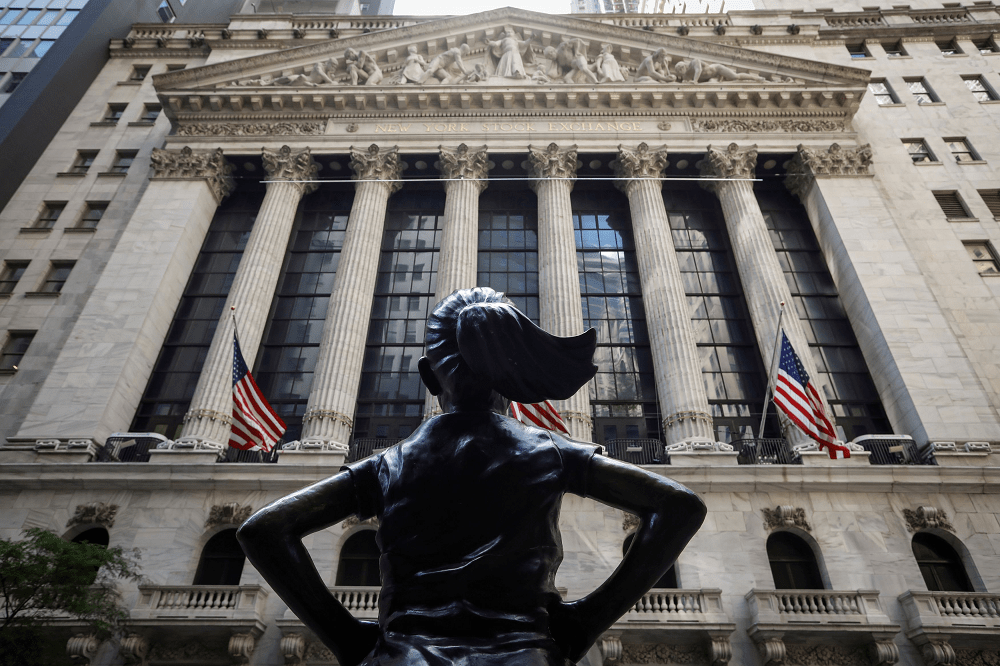

The S&P 500 reached a new all-time high for a fifth day in a row on Thursday, and briefly topped 3,500 for the first time ever. The Dow gained 160 points for its fifth positive day in six. The Nasdaq underperformed with a 0.3% loss, led by declines in Apple and Amazon.

The 30-stock average briefly wiped out its 2020 losses during Thursday’s session and is now just down 0.1% for the year. Stocks got a boost Thursday amid volatile trading after the Federal Reserve unveiled a major policy shift, allowing inflation and employment to run higher to continue to support the economy.

So far this week, the S&P 500 is up 2.5%, on pace for its best week since July 2 and its fifth straight week of gains for the first time this year. The Dow and the Nasdaq also have gained more than 2% each week to date.

Investors will monitor fresh economic data on Friday, including consumer spending, personal consumption expenditures as well as consumer sentiment.

Dow futures up 200 points in overnight trading after the index briefly erases 2020 losses, CNBC, Aug 28