U.S. stock futures rose in early Thursday morning trade after the worst day for the market in several months. Futures tied to the Dow Jones Industrial Average gained 291 points. Those for the S&P 500 and the Nasdaq 100 also traded in moderately positive territory.

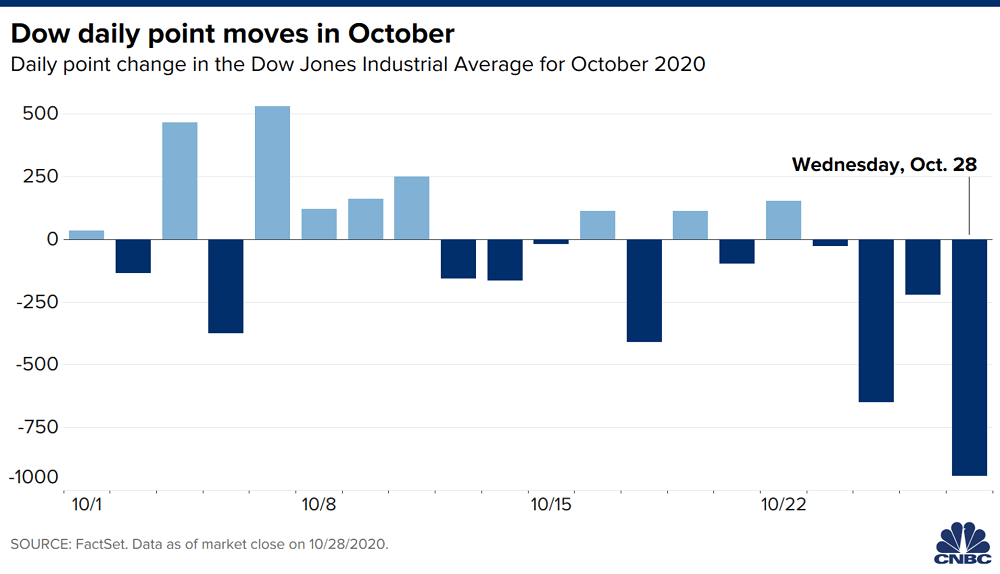

The move in futures comes after a sharp sell-off during Wednesday’s session that extended Wall Street’s losing streak. The Dow lost 934 points, or 3.4%, for its fourth-straight negative day and worst loss since June 11. The S&P 500 also saw its worst day since June 11, falling 3.5% for its third-straight negative session.

The tech-heavy Nasdaq Composite suffered a slightly larger loss at 3.7% after advancing modestly in the prior session, marking its worst performance since Sept. 8. The sell-off mirrored a rough day for European markets, as rising Covid cases on that continent spurred leaders of Germany and France to announce new economic restrictions for the next month. New cases have also been rising domestically, with former Food and Drug Administration chief, Dr. Scott Gottlieb, telling CNBC that the U.S. was on a path that is three or four weeks behind Europe.

The market decline also came as investors prepare for a massive day of corporate earnings on Thursday. Moderna, Yum Brands and Comcast, the parent company of NBCUniversal and CNBC, are scheduled to report before the bell.

The afternoon will bring quarterly results from many of the world’s largest tech companies, including Amazon, Apple, Facebook and Google-parent Alphabet. Combined, those companies have a market cap of more than $5 trillion.

Shares of Facebook and Twitter, which also reports results on Thursday afternoon, moved higher in extended trading after fellow social media stock Pinterest reported strong growth in revenue and monthly active users. Shares of Pinterest rocketed 28% higher in after hours trading.

Thursday will also feature a preliminary read on U.S. gross domestic product for the third quarter. Economists surveyed by Dow Jones expect growth of 32% on an annualized basis, but even that historic jump would leave the economy well below where it was before the Covid-19 pandemic and there are signs that the pace of the recovery has slowed in recent months.

Dow futures rise nearly 300 points as Wall Street looks to recover from worst sell-off in months, CNBC, Oct 29