U.S. stock futures were lower early Thursday morning as traders continued to weigh the prospects for a coronavirus aid deal being reached before next month’s election. Dow Jones Industrial Average futures were down 296 points. S&P 500 futures and Nasdaq 100 futures also traded in negative territory.

Treasury Secretary Steven Mnuchin said on Wednesday that reaching a coronavirus stimulus deal before the election would be difficult as Democrats and Republicans remain far apart on certain issues. His comments came after House Speaker Nancy Pelosi, D-Calif., said earlier this week that a recently proposed package by the administration “falls significantly short” of what is needed.

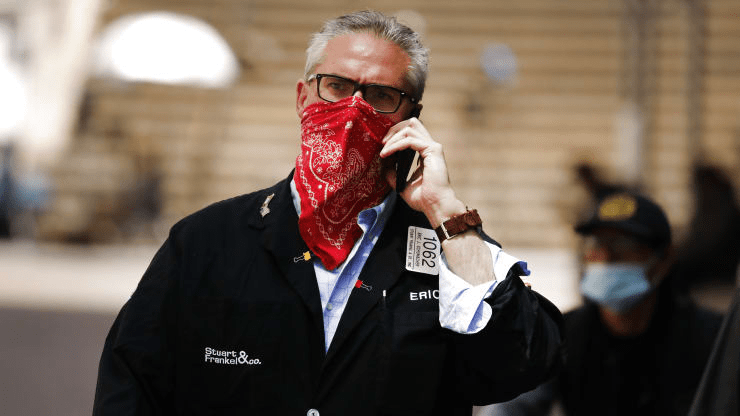

The uncertainty surrounding the aid talks led to the market’s second straight daily decline. The Dow slid more than 160 points, or 0.6%. The S&P 500 and Nasdaq Composite pulled back by 0.7% and 0.8%, respectively. Wednesday marked the first time since September that the major indexes posted consecutive daily losses.

On the data front, weekly jobless claims numbers are set for release Thursday morning along with the latest data on import and export prices.

Dow futures nearly 300 points lower as Wall Street struggles to bounce from 2-day slide, CNBC, Oct 15