Futures contracts tied to the major U.S. stock indexes rose in early Monday morning trade as investors pored over comments from Fed Chairman Jerome Powell on the state of the economy, in light of last week’s market losses.

Dow Jones Industrial Average futures climbed 309 points, implying an opening gain of almost 223 points. S&P 500 and Nasdaq futures also rose and pointed to modest advances for the two indexes at Monday’s open.

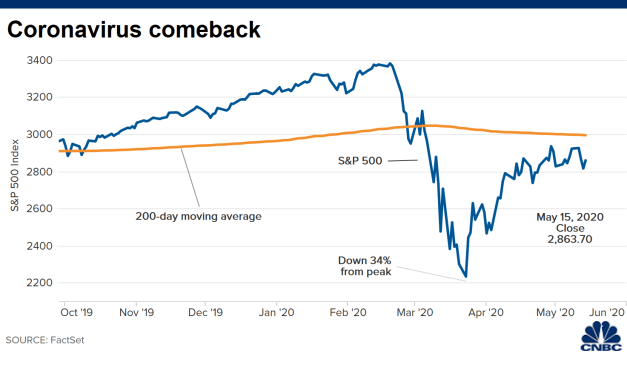

The overnight moves Sunday evening followed a red week on Wall Street. The Nasdaq Composite and S&P 500 fell 1.1% and 2.2%, respectively, last week with the latter notching its worst week since March. The Dow industrials finished the week down 2.65% for its third negative week in four and its worst week since April 3.

The central bank leader struck a cautiously optimistic tone, telling the show that he’s “highly confident” the U.S. economy will claw its way back from the current pullback, but warned that it may not fully recover until a Covid-19 vaccine is complete.

He also said he does not believe the current downturn will resemble the Great Depression some 90 years ago despite the possibility that the U.S. unemployment rate could peak around 25%.

“I don’t think that’s the likely outcome at all. We had a very healthy economy two months ago. Our financial system is strong,” he said. You have governments around the world, and central banks around the world, responding with great force and very quickly. And staying at it.”

A flurry of recent economic data, including record-setting unemployment figures and a 16.4% plunge in April retail sales, show just how abruptly state-imposed business closures impacted the broader U.S. economy.

Dow futures jump 300 points, rebounding from last week’s losses, CNBC, May 18