Stock futures traded in the red early Monday as Congress managed to seal a coronavirus stimulus deal hours before a shutdown deadline. Futures on the Dow Jones Industrial Average pointed to an opening drop of 300 points. S&P 500 futures and Nasdaq 100 futures both traded lower. At Monday’s open, Tesla will enter the S&P 500 with a 1.69% weighting in the index, the fifth largest.

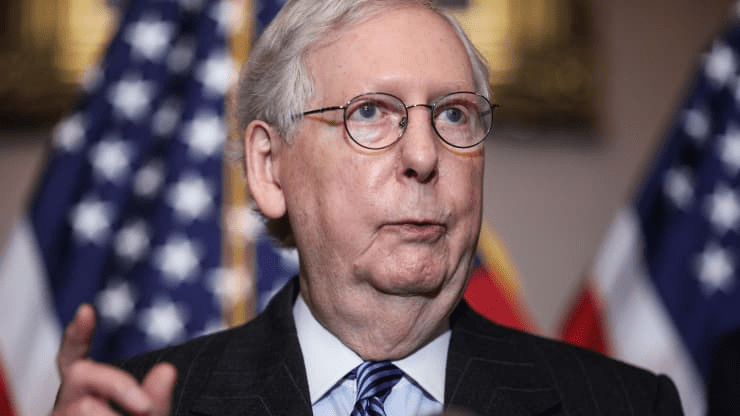

Senate Majority Leader Mitch McConnell and Minority Leader Chuck Schumer said lawmakers have reached an agreement on a $900 billion relief package, which would provide direct payments and jobless aid to struggling Americans. The announcement came after negotiators resolved a key sticking point by rolling back the Federal Reserve’s emergency lending powers. Congress passed a one-day spending bill to avoid a government shutdown that would have started at 12:01 a.m. ET Monday. President Donald Trump signed the measure late Sunday evening, according to White House spokesman Judd Deere.

Lawmakers will vote on the relief and funding bill on Monday. The major averages have recently risen to record highs amid optimism toward fresh coronavirus stimulus as well as the vaccine rollout. Moderna is shipping its first batch of vaccine doses after receiving approval for emergence use from the U.S. Food and Drug Administration. Meanwhile, the vaccines by Pfizer and BioNTech are being distributed to front-line health-care workers around the country.

With only two trading weeks left in 2020, the S&P 500 is up 14.8% for the year, while the 30-stock Dow has risen 5.8%. The Nasdaq Composite has rallied 42.2% this year as investors favored high-growth technology companies.

Dow futures drop 300 points as lawmakers reach last-minute stimulus deal, CNBC, Dec 21