The Dow Jones Industrial Average fell on Wednesday as investors awaited an update from the Federal Reserve on the state of the economy and status of any further stimulus from the central bank.

The 30-stock Dow dropped 145 points, or 0.5%, as Boeing shares slid more than 5%.The S&P 500 dipped 0.17%. The Nasdaq Composite rose 0.6% and hit a fresh record high as gains in major tech stocks limited the broader market’s decline.

Shares of Amazon and Apple gained more than 2% each and hit all-time highs. Alphabet and Netflix rose 0.6% and 0.2%, respectively. Stocks that would benefit from the economy reopening — which have outperformed in recent weeks — fell broadly. American Airlines, United and JetBlue all dropped more than 6%. Wells Fargo slid about 6% while Citigroup lost 3.7%. JPMorgan Chase traded about 2% lower.

The Fed is expected to keep policy unchanged, but investors will be watching for thoughts on possibly implementing yield caps and strengthening forward guidance on how long the Fed will keep current policies in place. The Fed will be revealing its first forecast for the economy and interest rates since late last year, as it skipped a forecast in March just as the pandemic forced the abrupt shutdown of the economy.

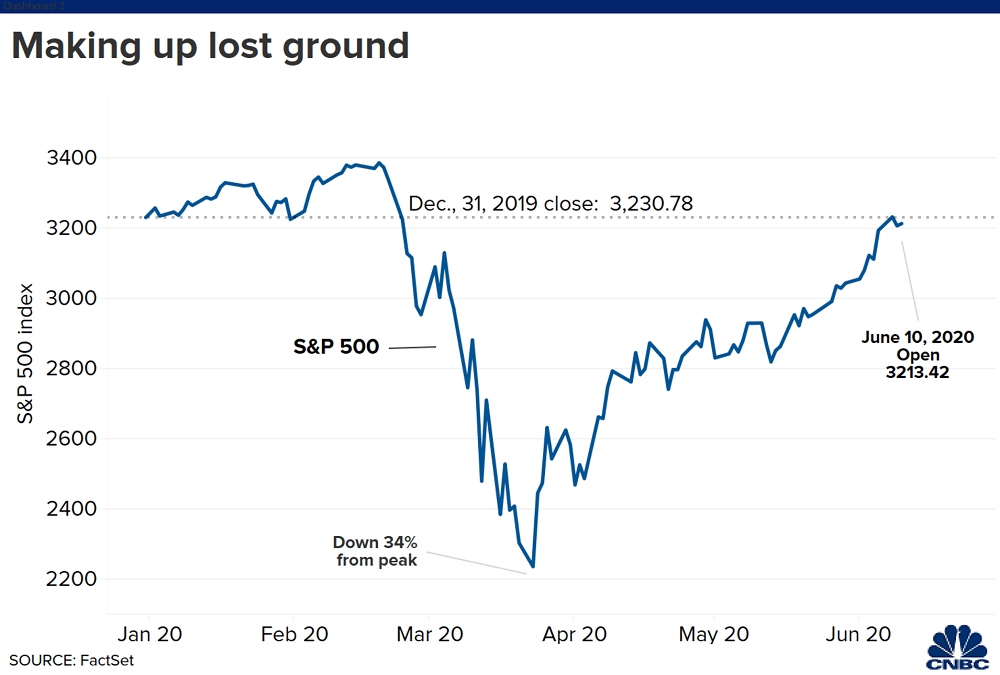

The Dow and S&P 500 were under pressure on Tuesday as stocks benefiting from the economic reopening fell broadly. The Dow fell 300 points or 1.1%, snapping a 6-day winning streak. The 30-stock average was dragged down by a 5.9% drop in Boeing. The S&P 500 lost 0.8% on Tuesday. The index briefly turned positive for the year on Monday.

Dow falls more than 100 points ahead of Fed update, Boeing drops 5%, CNBC, Jun 10