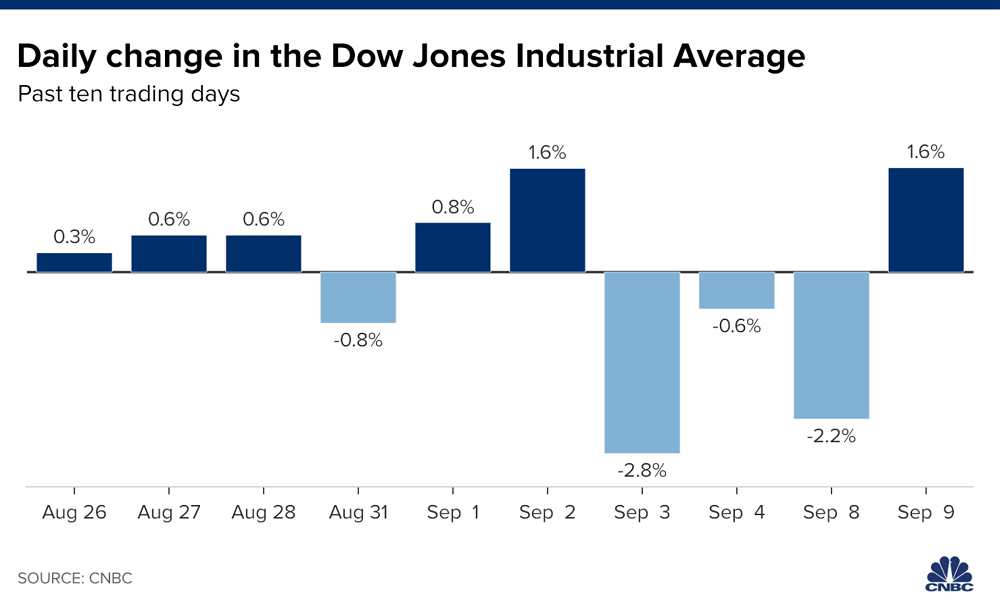

Stocks fell in choppy trading on Thursday as tech shares struggled to build on the sharp rebound from the previous session. The Dow Jones Industrial Average traded 200 points lower, or 0.7%. Earlier in the session, the Dow was up more than 200 points. The S&P 500 dipped 0.7% and the Nasdaq Composite was down 0.4% after surging as much as 1.4%.

Apple shares were down 1% after rising as much as 2.7%. Tesla, which was up more than 7% at one point, traded 4.7% higher. Netflix and Microsoft were both lower along with Facebook, Amazon and Alphabet. Thursday’s moves follow a broad rally for the market on Wednesday, with the S&P 500 posting its best day since June. The Nasdaq pulled itself out of correction territory after a sell-off for major tech stocks dragged down the market for three straight sessions.

The three-day drop came amid increasing worry on Wall Street about a tech bubble, with those stocks fueling the Nasdaq to record highs despite the coronavirus pandemic’s hit to the economy. Some said the pullback did not go far enough, with Duquesne Family Office CEO Stanley Druckenmiller telling CNBC on Wednesday morning that the market was in an “absolute raging mania.” Traders pored over key unemployment data on Thursday. The Labor Department said the number of first-time filers for unemployment benefits came in at 884,000. Economists polled by Dow Jones expected claims to come in at 850,000.

Dow drops 200 points in volatile trading, Apple slides 1%, CNBC, Sep 10