The Dow and broader U.S. stock market were mixed during Monday’s open, as Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) began trading at their new split-adjusted price. While not a component of the Dow or S&P 500, Tesla has become an important proxy for investor sentiment in the current market cycle.

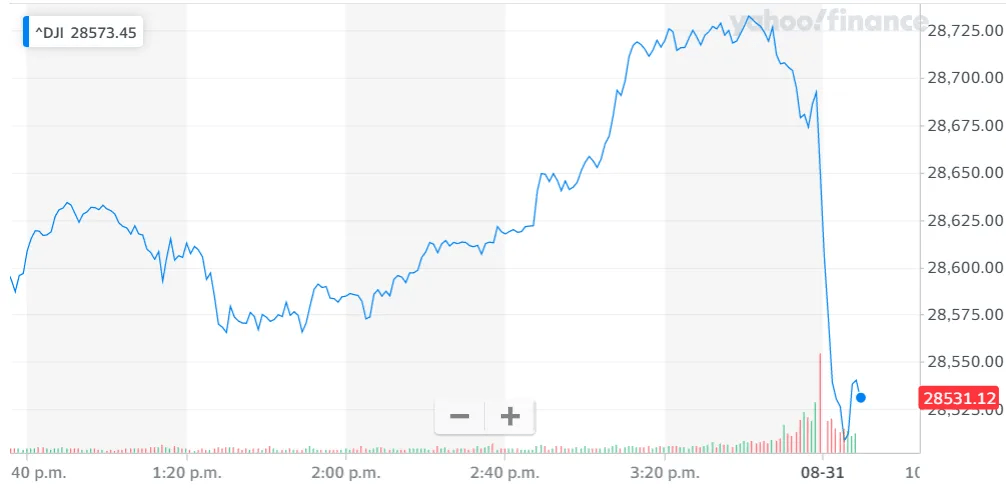

Futures contracts for all three major U.S. stock indexes wavered ahead of Monday’s opening bell. By the open, the Dow Jones Industrial Average was down roughly 110 points. The broad S&P 500 Index of large-cap stocks declined by 0.1%. The Nasdaq Composite Index rose 0.3%. The S&P 500 and Nasdaq set multiple records last week, while the Dow closed at its highest level in six months.

Dow blue-chip Apple Inc. opened sharply higher after its four-to-one stock-split took effect. Apple is trading at a new split-adjusted price of $127.64, having gained 2.3%. Tesla’s five-for-one stock split also took effect Monday. TSLA rose 0.6% to $4445.58.

The U.S. stock market has defied expectations recently, thanks in large part to an extremely dovish Federal Reserve. Fed Chair Jerome Powell announced a historic policy shift last week that allows the central bank to create more inflation to drive economic expansion. Fed officials will allow inflation to rise above 2% so long as ‘average inflation’ evens out over time. Watch the video below.

Dow Drops 130 Points; Apple Stock Split Fuels Tech Gains, CCN, Aug 31