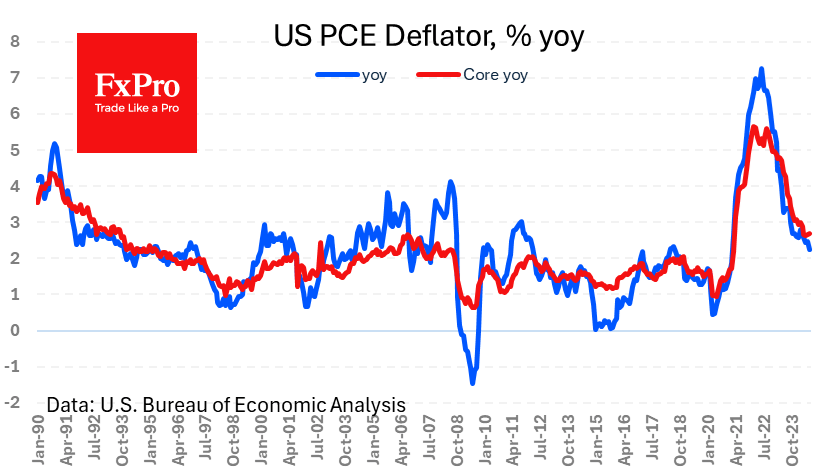

The core US personal consumption price index (the Fed’s preferred inflation gauge) rose slightly less than expected to show inflation at 2.7% y/y. The indicator is above the target of 2% in February 2021 and accelerated with 2.6% in the previous two months.

Just over a week ago, the Fed decided to make a decisive 50-point cut in the federal funds rate, even though inflation was well above target. In addition to that, the fact that the Fed is following the updated strategy whereby the Fed is aiming for 2% ‘over the period’ raises questions. This means that it will take several months or quarters before the technical signal of easing policy because of inflation. The latest report does not change the expectations of the Federal Reserve System’s market, giving a 52% chance to reduce the rate by 50 points at the next meeting in early November. Such expectations and the actual dovishness of the central bank fuel risk appetite in the financial markets.

No less important in the published report are the indicators of private consumption. Formally, the monthly momentum was worse than expected, with spending rising 0.2% versus 0.5% and expectations of 0.3%, and incomes rising 0.2% versus 0.3% and expectations of 0.4%. However, the Bureau of Economic Analysis revised these data series from January 2019 with significantly higher income figures, which boosted the savings rate. Previously, the savings rate had been close to its pre-mortgage crisis low of 3%, but now it’s 4.8% in the latest data and 5.1% on average over the past six months.

The much more optimistic income estimate largely explains the resilience of spending growth in recent months, which we have attributed to the debt burden. However, it is also a pro-inflationary risk.

Either way, if it doesn’t worry the markets or the Fed, strong spending growth boosts the economy and is good for equity valuations.

The FxPro Analyst Team