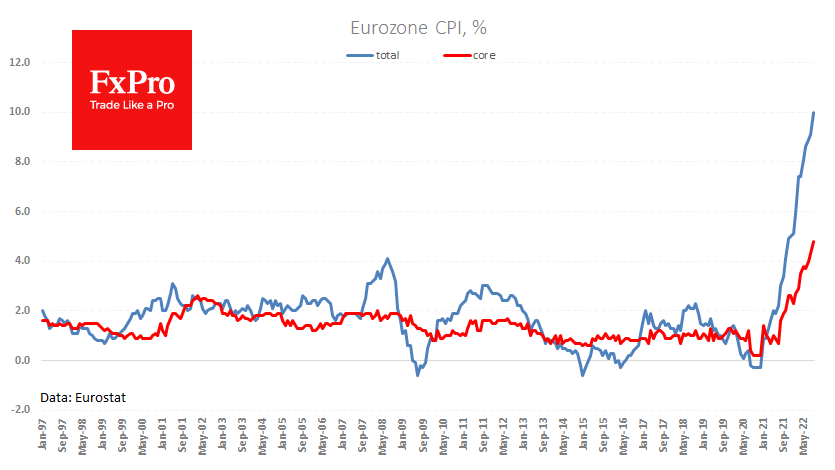

According to a preliminary Eurostat estimate, overall inflation in the euro area reached 10% y/y in September. The growth rate accelerated sharply from 9.1% a month earlier and is notably above the forecast 9.7%.

An additional concern for the ECB was the acceleration of core inflation from 4.3% to 4.8%. The core CPI growth rate is almost double what it was at the previous peak in 2002.

But there is an interesting detail. The current price surge has allowed the eurozone’s all-time average to rise to 1.8%. This is the level that the ECB had previously cited as a desirable benchmark.

For investors and traders, Eurozone inflation above expectations is a bullish factor as it promises more aggressive interest rate rises soon. We should also remember that inflation in the eurozone has not yet peaked, and officials are setting their sights on higher levels in the coming months. In comparison, on the US side, there are signs that the peak of price growth there is now behind us.

The FxPro Analyst Team