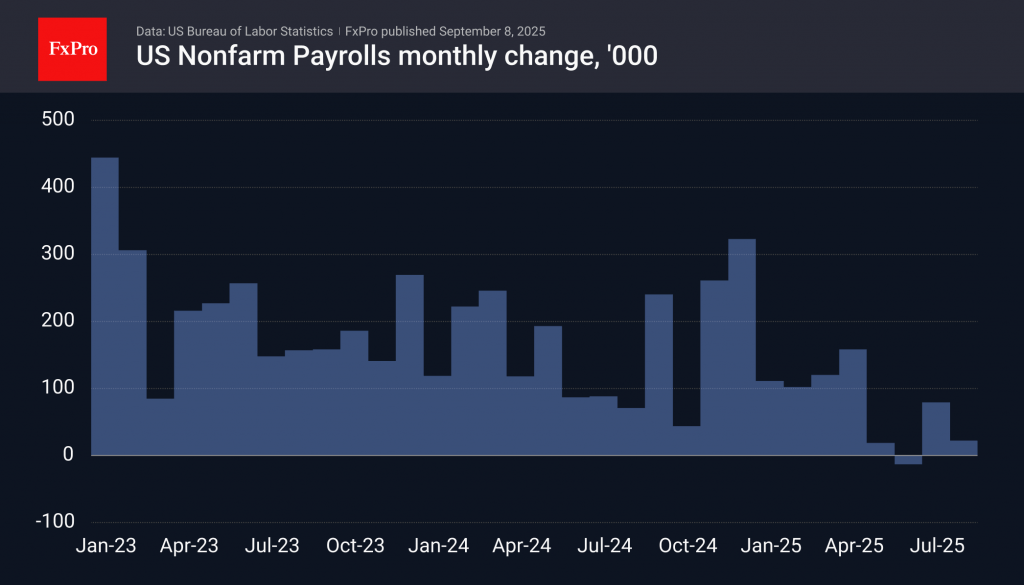

For the second month in a row, US employment data has been disappointing, not only in terms of the headline figure but also due to a significant revision of previous data. As a result, the economic picture looks increasingly bleak.

In August, the economy created 22K new jobs, compared to the expected 75K. But more importantly, there was a reduction of 13K in June, although the initial report spoke of an increase of 147K. The labour market has been limping since May, which is entirely consistent with the shock of sanctions. This has radically changed the description of the labour market in recent months.

It is also worth noting that employment in the manufacturing sector has been steadily falling over the past four months. Directly, they represent only 8% of all jobs in the US, but their influence and significance as a leading economic indicator are many times greater. However, the rate of decline here is significantly lower than it was during the period of active deindustrialisation in 2000-2009.

An important indicator of market fear: they have priced in a 100% chance of a Fed rate cut in September and estimate a 10% probability of a 50% cut. This is a noticeable shift over the past two weeks, when an 80% chance of a 25-basis-point cut was priced in.

We believe that a double cut in September or other months is nothing more than a bull’s dream. We assume that three cuts by the end of the year and four to five cuts by March next year are more realistic.

Inflation has been and remains an important restraining factor. Key metrics are still well above the Central Bank’s 2% target. At the same time, inflationary risks remain, and the tariffs that have already been introduced are not yet fully reflected in prices.

The Fed often ignores inflation in favour of supporting the economy, and this may happen again, as Powell made clear at the end of August when he launched the latest outlook reassessment.

However, after about a year of inaction, a 50-basis-point move would look like panic or an admission of guilt. Since saving face is an important task for the Fed, including for the sake of market confidence, we do not expect a 50 b. p. cut in September or in late October.

The stock market continues to see the good in the bad, adding to expectations of a more accommodative monetary policy. However, the experience of previous corrections suggests that only strong volatility in stocks makes the Fed accommodative enough to create conditions for stock growth and economic acceleration.

Similar rules can be applied to the currency market, where pressure on the dollar is growing in tandem with easing rate expectations. However, at some point, dollar assets may prove to be the most reliable choice in the markets if traders realise that they have gone too far in their expectations of Fed easing.

The FxPro Analyst Team