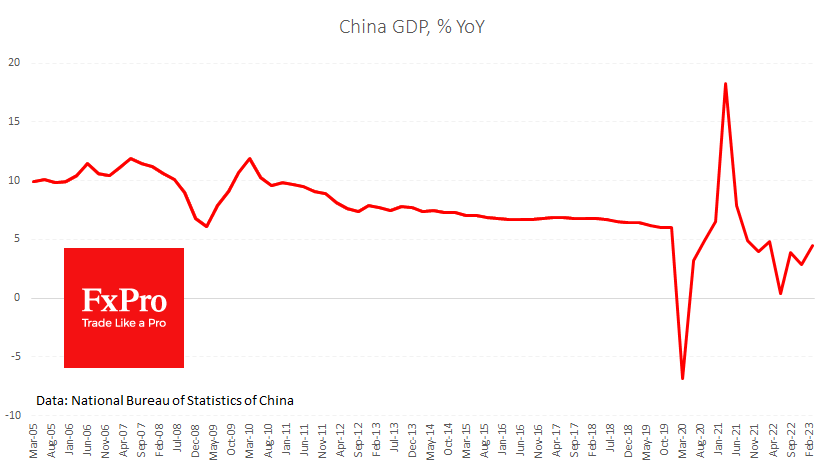

China released a large set of statistics this morning from which it’s difficult to draw clear conclusions, although GDP growth was stronger than expected.

The Chinese economy grew by 2.2% in the first three months of the year and is 4.5% higher than a year ago. This is stronger than the 4% forecast. Last year, the economy grew by only 3% against a government target of 5.5%. The 5.0% target for 2023 is less ambitious. Given lifted pandemic restrictions and recovering global trade, achieving and exceeding it is relatively easy.

Separate reports on industrial production and retail sales suggest domestic demand remains the main driver, putting it on a faster growth path. Retail sales in March were 10.6% higher than a year earlier (7.3% expected). The cumulative YTD increase was 5.8%, much higher than expectations (3.7%) and the growth rate for the same period last year (+3.3%).

At the same time, the unemployment rate fell from 5.6% to 5.3%, returning to the level of December 2021.

However, industrial production surprised on the downside, rising by 3.9% year-on-year in March, less than the 4.7% expected. China’s industrial production is often seen as a bellwether for a global industry. The low growth rate could signal how hard the global economy is growing under the pressure of rising interest rates. Fixed asset investment has been stagnant at around 5% year-on-year, with a slight downward trend, which is also worrying.

However, in recent months there has been much talk of foreign companies shifting production from China to other Asian countries, which is negative for the former but positive for the latter.

The FxPro Analyst Team