The cautious strengthening of the Dollar continues, and this is not yet a signal of a widespread exit from risk assets, but a sign that the Dollar is recovering from its 12% slump between March and early September. This marked the beginning of the US dollar’s pullback from important round levels but is not yet a sign of a deeper reversal of sentiment in favour of the USD.

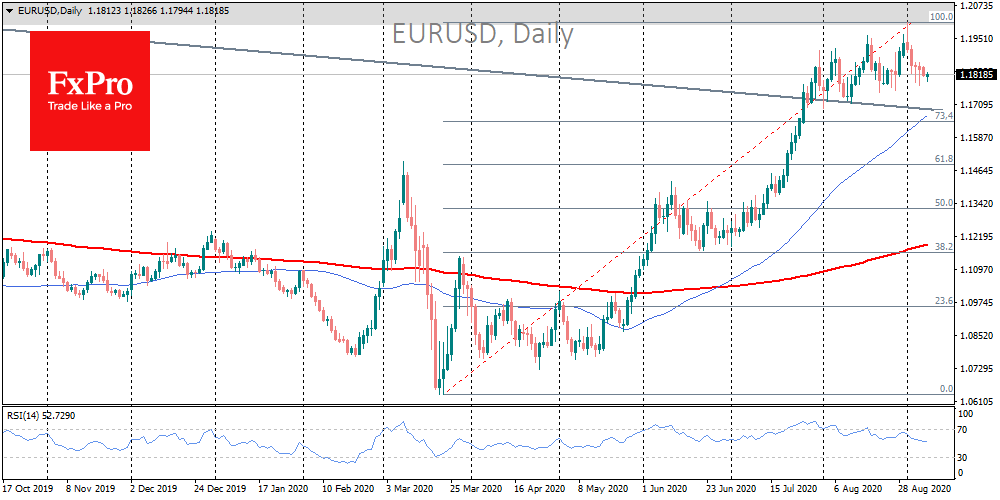

The Dollar Index is looking positive in September, with all six trading sessions showing strengthening. In EURUSD, a counterattack signal came after a swift slippage above 1.2000 on the first of September. Since then, the pair has been slowly but surely declining, testing support at 1.1800 and correcting 23.6% of the growth momentum of the last two months.

The GBPUSD a week ago was just one step away from 1.3500, turning south with the euro, and declining slightly more active than the euro, already supplying the Dollar 30% of the previous month’s momentum.

Its reversal from an important round level was also shown in the USDCHF, which fell below 0.9000 at the beginning of the month but has since moved up to 0.9180.

Thus, the dollar bull attack in the three most crucial European currency pairs also took place from psychologically critical levels at the very beginning of September. With a slight stretch, the same can be said about USDJPY, which, time after time, returns to growth after brief failures at 105.

With the recent move, markets received a signal that the Dollar is still too early to write off. This is doubly true, given the significant improvement in macroeconomic indicators in the US in recent weeks. Besides, there are ongoing discussions in Congress about new stimulus packages that will result in the US Treasury having to borrow hundreds of billions or even trillions of dollars in the debt markets soon. This is better to do when buyers are confident in the Dollar’s prospects so that Treasury does not find itself in a situation where the seller has too many “goods” with poor demand.

However, the Fed’s new strategy of average inflation promises to constantly erase the Dollar, as does the high level of government debt in the United States, which creates a huge supply of Treasuries.

Still, it is worth looking at the current dollar growth wave as consolidation at significant levels before the next step of the Dollar’s retreat. A more optimistic outlook for the Dollar can be seen after the EURUSD’s failure below 1.1750. Only a fall below 1.1550, a 38% correction from the March-September rally, can definitively draw a line under our optimism. On GBPUSD, a similar bearish signal will be received after the pair falls below 1.2700, and the USDCHF needs to grow to 0.9350 first.

Without accelerated growth of the Dollar and the above levels being reached, we remain within the weakening pattern with short corrections. In this case, if the EURUSD reverses, the next stop for the pair may be the levels close to 1.2500, GBPUSD to 1.42 and USDCHF to 0.8700.

The FxPro Analyst Team