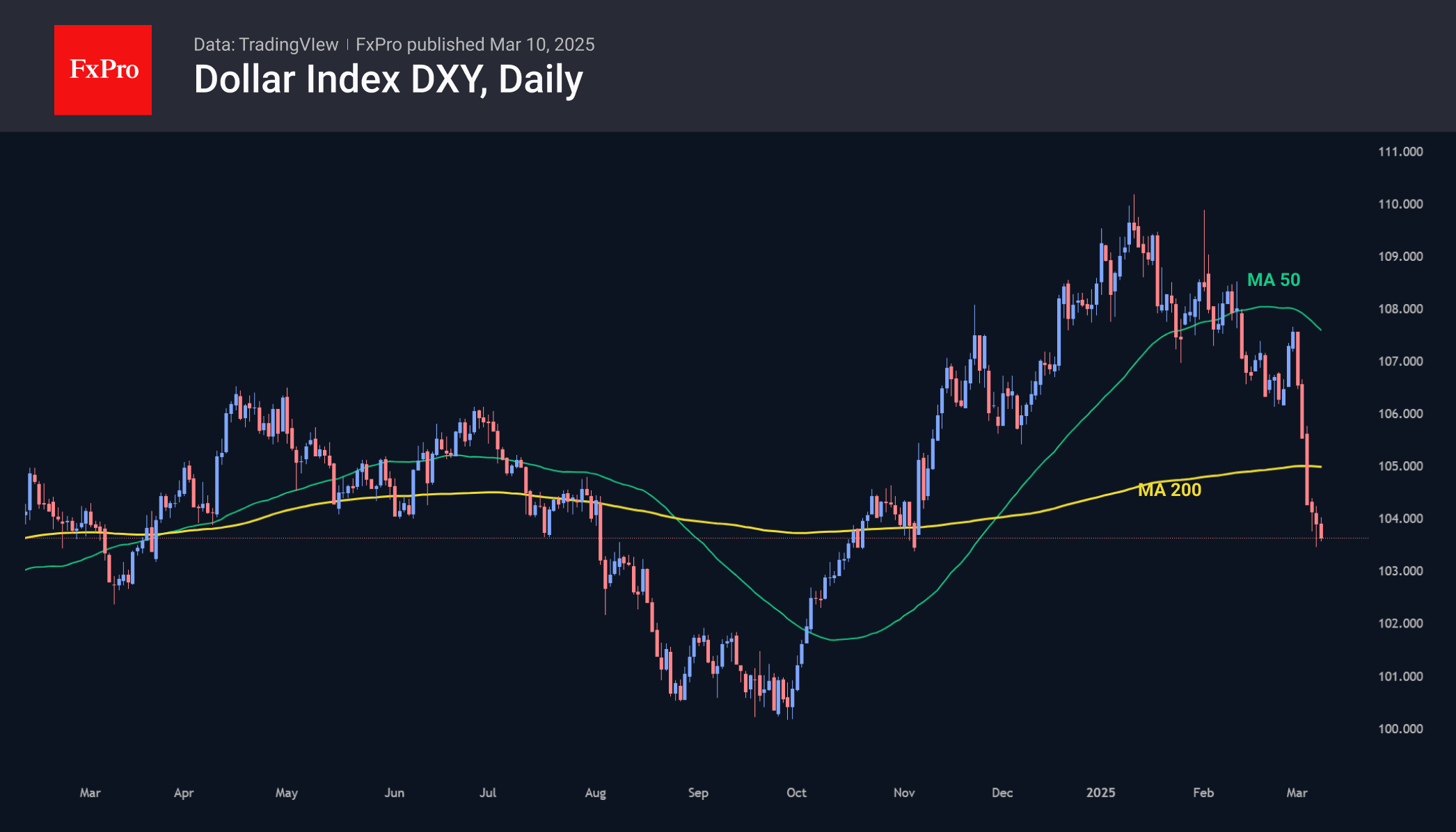

The dollar plunged rapidly last week, losing over 3.5% and pulling back to levels below 104.0, nearly erasing gains since Trump’s election victory.

The US dollar has been actively declining since early February and intensified the decline at the start of this month. An attempt to climb above the 50-day average at the end of February was met with intensified selling, and this week, the price has already pulled back below the 200-day.

A popular explanation is that the dollar is suffering because of Trump’s tariffs. It is correct to call the dollar’s decline a reassessment of expectations for the US Fed key rate.

The odds of two or more key rate cuts before the end of the year exceed 90% vs. 48% two weeks earlier.

A big EU defence spending plan and a dramatic shift in budget planning approaches in Germany lead to lower expectations for a key rate cut.

This news has caused the single currency to rally against most of its peers, most notably in the pairing with the dollar, where we have seen a 4.5% rally since the start of the week.

Higher-than-expected inflation in Japan is also setting the stage for a key rate hike, perhaps as early as March 19th. In other words, the gap in monetary policy is closing rapidly on both sides.

The FxPro Analyst Team