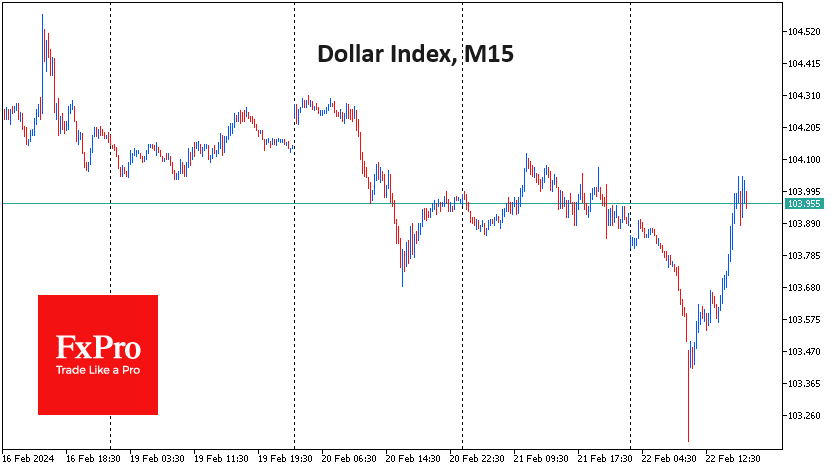

Something important happened in the currency markets on Thursday. The initial and relatively sharp fall of 0.7% in the dollar index was reversed, and now, as trading begins in New York, we are seeing a strengthening to the day’s opening level.

In terms of news, the disappointing Eurozone PMI data helped to halt the dollar’s slide. Just as notably, buying US currency has increased significantly with the start of active trading in the US.

The release of the weekly jobless claims can be seen as a supporting factor. This is another robust data with initial claims falling to 201 thousand (minimum for five weeks). Continued claims came in at 1.862 million against a forecast of 1.885 million. This data fits perfectly into the picture of a strong US economy, which will allow or even force the Fed not to rush to cut interest rates.

But we are also looking at another factor – Nvidia. The company once again blew away expectations for last quarter’s revenue and future guidance. It is quite possible that the company’s report, together with the solid macroeconomic data, is attracting capital from abroad to the US markets, supporting interest in the dollar.

A more fundamental approach is also valid: a strong labour market and confident corporate forecasts are a strong plus for higher interest rates in the long run.

The FxPro Analyst Team