After an initial decline, the USD began to rally on the back of US employment data that dampened expectations of a 50-basis point rate cut by the Fed in September.

The US employment data, which triggered a fall in the stock market, led to a wave of USD buying, although a similar sell-off in early August put pressure on the USD. The correlation between equity and currency markets can be either positive or negative. Still, historically, the negative correlation is more persistent: a weaker USD stimulates interest in equities. In contrast, a sell-off in equities drives investors into short-term bonds and the USD as a safe haven.

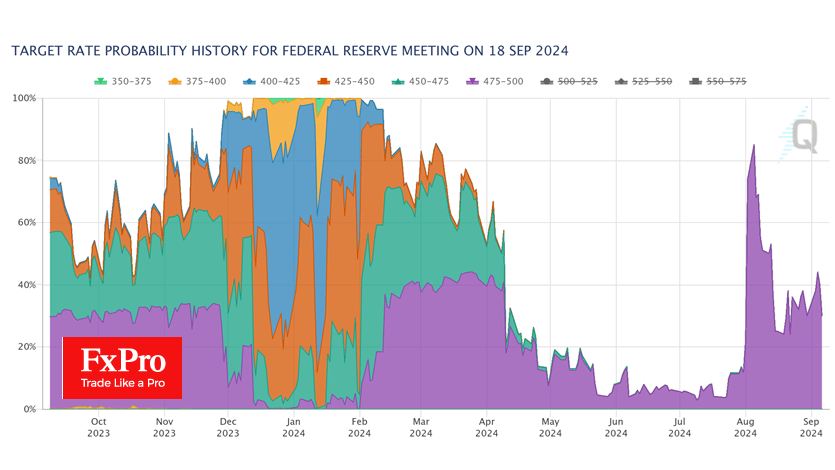

The probability that the Fed will cut rates by 50 bps in September has fallen to 30%, leaving 70% for a typical 25 bps cut. Friday’s report showed that the economy is creating jobs at a near-trend pace, the unemployment rate remains historically low, and wages are rising faster than inflation. While slowing inflation and job growth do not preclude a rate cut from multi-year highs, there is no need for emergency action.

Expectations reversed about an hour after the NFP was released as market participants delved into the report’s details. This followed a wave of speculative dollar selling triggered by the gap between forecasts and actual data.

As a result, the dollar index reversed to the upside from key support near 100.5, a reversal area from last December. Near these levels, the dollar has repeatedly reversed from declines to gains since May 2022. Between 2015 and 2020, dollar sales around these levels intensified, preventing the dollar from consolidating higher for a long time.

Other long-term technical signals include a reversal from the 200-week moving average and a return from overbought territory on the RSI.

We noted the importance of this line a few weeks ago, suggesting that the dollar sell-off could accelerate without a change in market sentiment. The pendulum has swung in the dollar’s favour in recent weeks. However, it will take strong US CPI and Fed confidence in the economy to keep the DXY above this historic reversal area.

The FxPro Analyst Team