Stock market sentiment is moving out of the extreme fear zone it plunged into last week, and the dollar has paused its strengthening. Friday’s CPI report came in slightly weaker than average forecasts, reducing the fear of future Fed monetary policy.

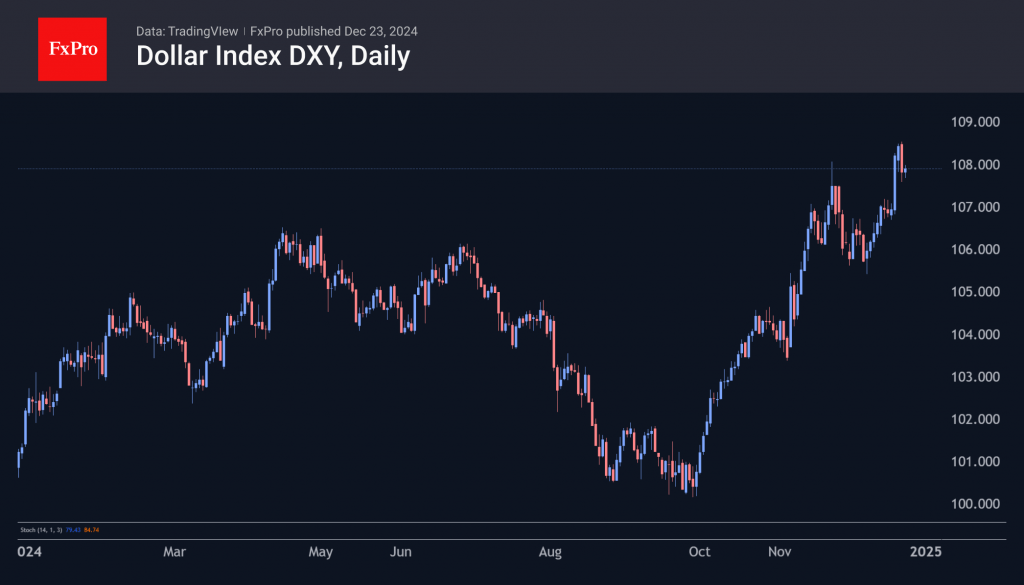

Traders probably assumed that the Fed had better information about recent inflationary trends, which caused the sell-off in US equities to accelerate and expand. However, Friday’s data eased the pressure, allowing the indices (except for Russell2000) to begin to recoup losses. The dollar index took a step back, returning below 108, while EURUSD bounced above 1.04 and GBPUSD above 1.25.

One can understand the change in tone from Fed members, as the Personal Consumption Price Index accelerated to 2.4% y/y against 2.3% in October and a low of 2.1% in September. The Fed’s preferred inflation gauge showed gains of 2.8% y/y in November and October. That, too, is an acceleration from June’s 2.6%, the lowest in this cycle. On the other hand, it is lower than the 2.9% y/y anticipated.

Favourable vibes were reinforced by the University of Michigan report, which showed inflation expected in a year at 2.8% vs. the first estimate of 2.9% and the same expectations but accelerating from 2.6% previously.

Friday’s data triggered short-term profit-taking in dollar long positions. The effect is unlikely to be long-lasting, affecting the intensity of the current trend but not the direction. Inflation remains above target, accelerating instead of slowing. US economic activity is currently better than many peers, keeping the balance in favour of higher interest rates compared to other G10 currencies.

Simply put, fundamentals continue to point to the potential for a stronger dollar, bringing it closer to parity with the euro in the next couple of weeks and into the 0.95 area by the end of Q1 2025. The dollar index would then return to the 2022 highs, entering the 112-115 territory.

The FxPro Analyst Team