The dollar came back under pressure Friday as investors weighed fading prospects for a stimulus deal in Washington against disappointing U.S. jobs data. Stocks were mixed and oil extended an overnight gain.

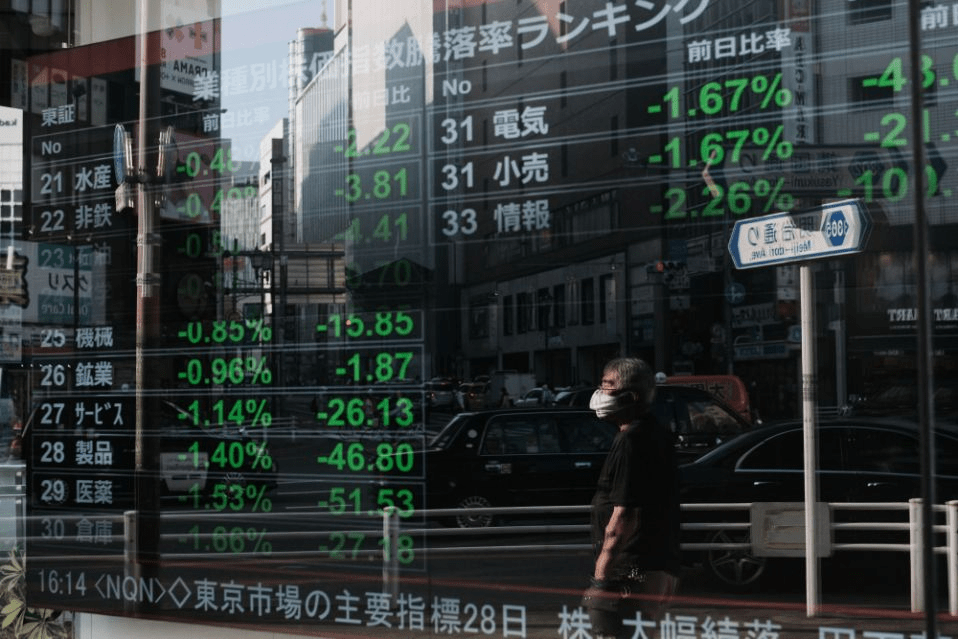

The yen pushed higher and the euro strengthened on a further monetary policy boost in the region. S&P 500 futures fluctuated after the index dipped for a second day without any signs of a breakthrough on the top issues that have held up a stimulus deal by lawmakers. Shares rose in Japan and South Korea and slipped in China. U.S. employment data suggested that widening business shutdowns to curb the pandemic are spurring fresh job losses.

Treasuries held overnight gains after a strong 30-year bond auction. The pound fluctuated as U.K. Prime Minister Boris Johnson warned Britain should prepare to leave the European Union without a trade deal. Airbnb Inc. more than doubled in its trading debut. After the close of U.S. markets Thursday came news that the first Covid-19 vaccine expected to be deployed in the U.S. won backing of a panel of government advisers.

The fate of an additional relief package remains unresolved as Democrats and Republicans continue to negotiate. Senate Majority Leader Mitch McConnell is now on board with Mnuchin’s $916 billion proposal, and cited the need to do “everything we can” to help the economy. Meanwhile, Pelosi sees the other $908 billion plan still being drafted by a bipartisan group of lawmakers as the best path to a deal.

The European Central Bank escalated its efforts to shield the region from a possible double-dip recession with another burst of monetary stimulus, while cautioning that it may not use up all the new firepower.

Elsewhere, oil in London climbed above $50 a barrel for the first time since the pandemic. Futures in New York traded near $47 a barrel.

These are some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:20 a.m. in London. The index decreased 0.1% on Thursday.Japan’s Topix index rose 0.3%.Hong Kong’s Hang Seng rose 0.2%.Shanghai Composite fell 1.4%.South Korea’s Kospi added 0.9%.Euro Stoxx 50 futures fell 0.3%.

Currencies

The Bloomberg Dollar Spot Index fell 0.1%.The euro was at $1.2157, up 0.2%.The pound bought $1.3324, up 0.2%.The yen rose 0.2% to 104.04 per dollar.The offshore yuan was at 6.5248 per dollar, up 0.2%.

Bonds

The yield on 10-year Treasuries held at 0.91%.Australia’s 10-year yield was steady at about 0.98%.

Commodities

West Texas Intermediate crude rose 0.2% to $46.89 a barrel.Gold held at $1,834 an ounce, little changed.

Dollar Slips With Stocks Mixed; Oil Extends Gain: Markets Wrap, Bloomberg, Dec 11