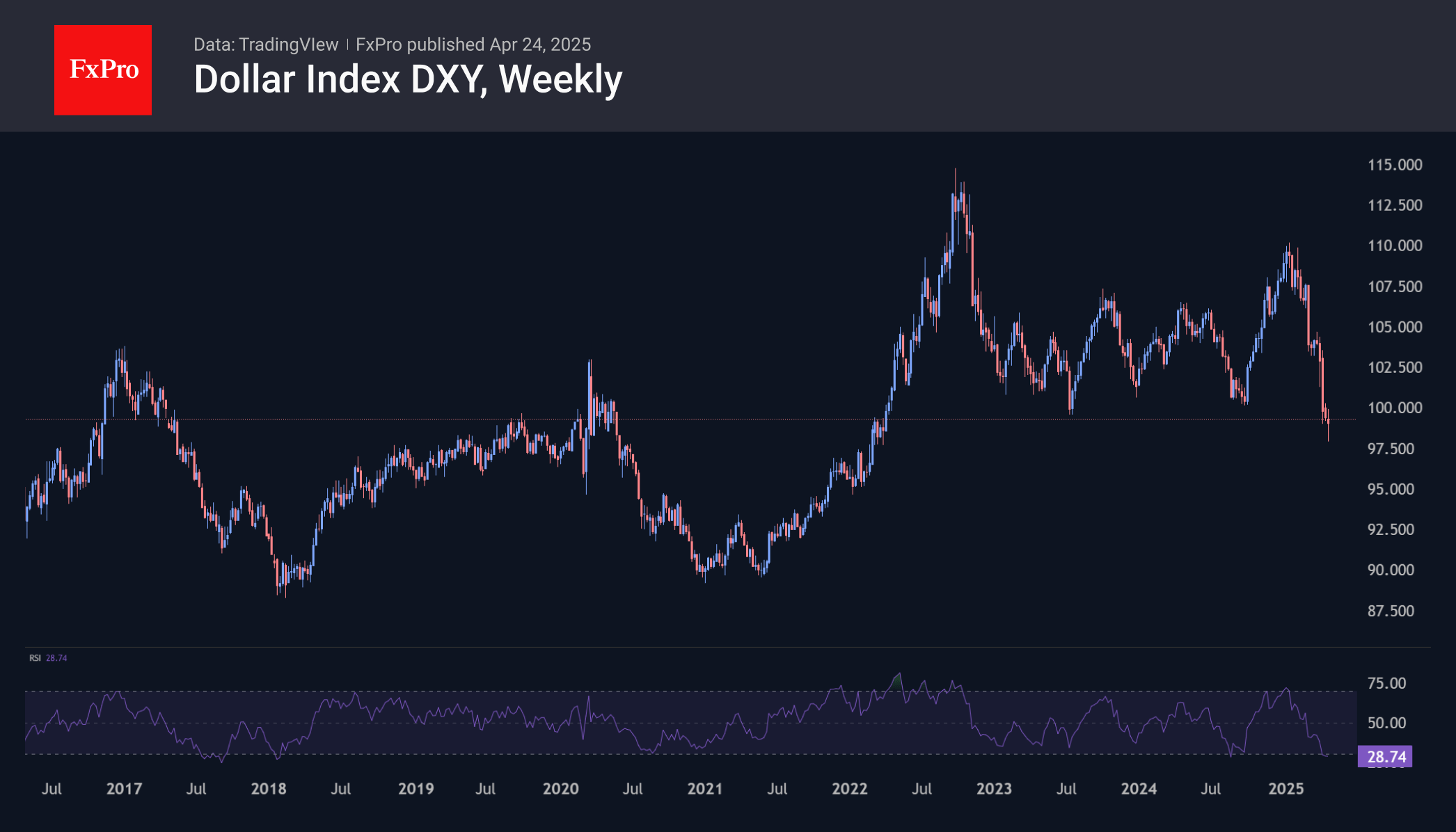

The U.S. currency started the week by hitting three-year lows against a basket of key currencies, but soon closed the gap on DXY, rising from 97.7 to 99.7. However, the upward trend has not yet developed. Unresolved trade disputes between the US and China continue to undermine the US currency’s position, creating impulses for a simultaneous sell-off in USD, equities and bonds.

We saw positive traction when markets received assurances that Trump would not fire Powell. But we also continue to note the Fed’s rather hawkish rhetoric. Open Market Committee members are openly saying they will not rush to cut rates and are wary of the impact of tariffs on inflation. That said, interest rate futures give a more than 50% chance of four. That’s a marked shift from 2-3 cuts a month earlier, which underlies the current dollar weakness. It’s a worrying bet that Powell will have to pull the economy out of recession at the end of the year.

Technical analysis suggests an increased chance of a corrective bounce since the start of the year, as there is consolidation after the failure. At the same time, historical data previously showed that after the rebound, one should be ready for a new wave of decline in the US currency.

The FxPro Analyst Team