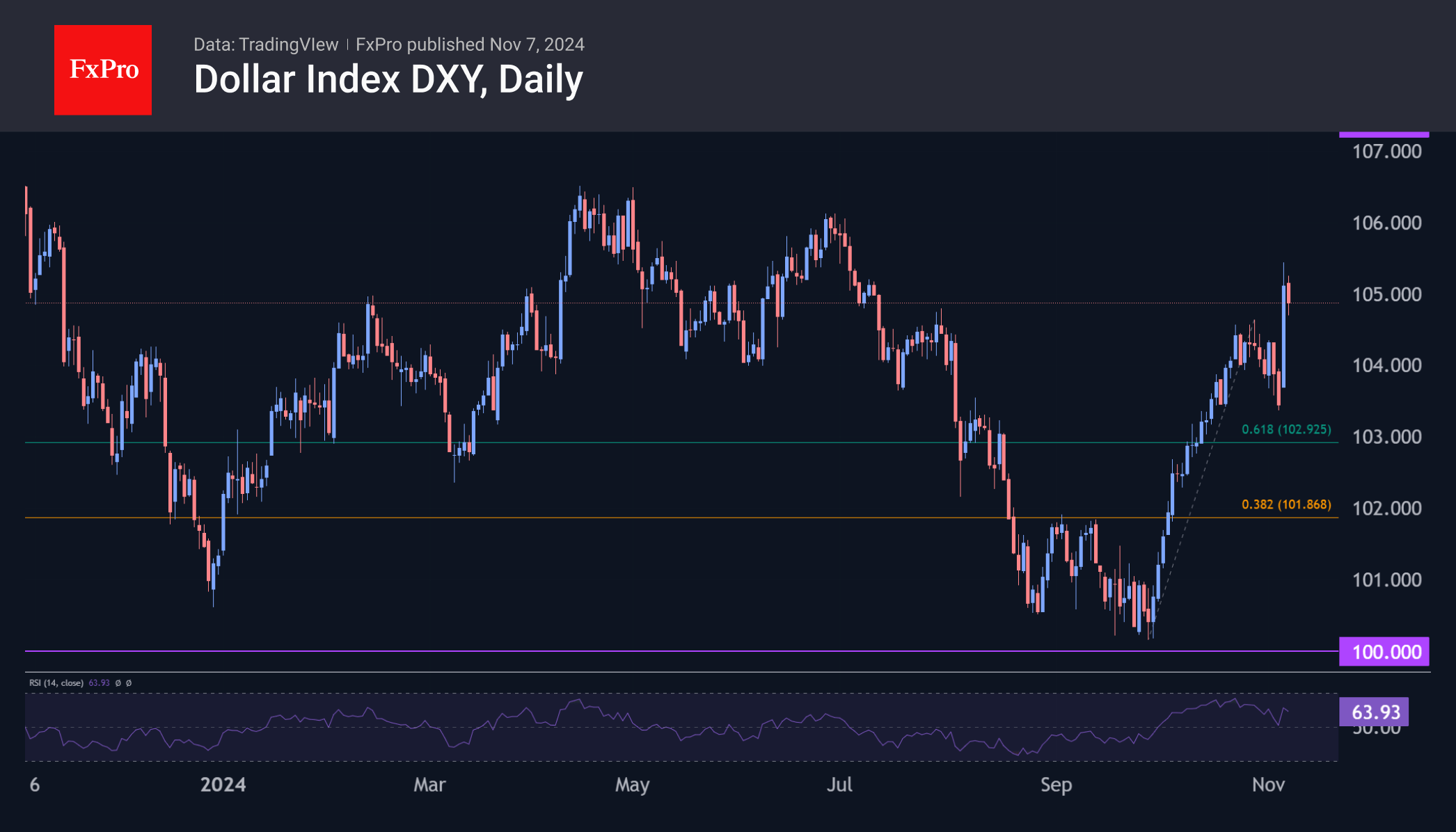

The dollar index rallied on the US presidential election results, picking its way up after consolidation and correction in recent weeks. Technically, this could be the start of a rally into the area of last year’s highs, creating a potential upside of 2-4% from current levels. In the longer term, a climb into the region of the 2022 highs cannot be ruled out.

The markets widely discuss Trump’s pro-inflationary policies, which will force the Fed to reconsider the pace of rate cuts next year. For now, this is out of the realm of speculation. We are more inclined to see higher tariffs, resulting deficit reduction, and manufacturing investment in the US as potential reasons for a stronger US currency over the next couple of years.

The FxPro Analyst Team