The dollar retreated on Monday against major peers as a wave of M&A deals lifted the mood on global equity markets and investors looked ahead to an event-packed week which includes a Fed meeting and the appointment of a new Japanese premier. Attention focused on the pound as the UK parliament prepared to debate a draft bill which the government admits breaches the terms of its EU divorce treat. The currency firmed 0.4% versus the dollar after suffering its worst week since March.

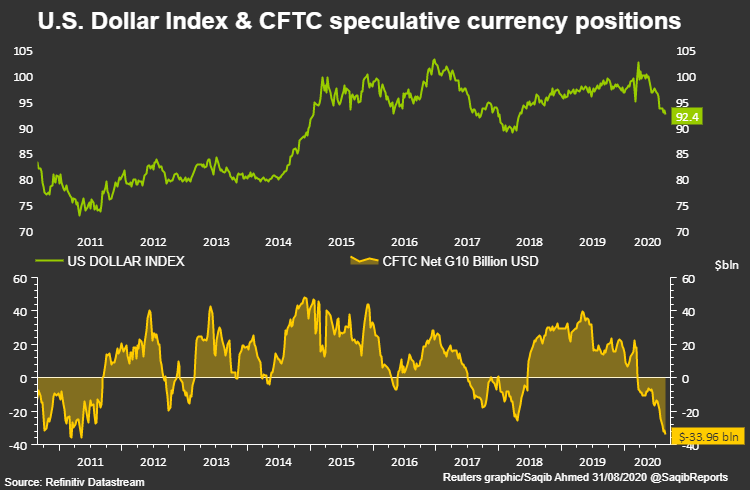

The gain was partly down to the dollar index which slipped 0.2%, after firming for two weeks straight. This week’s U.S. Federal Reserve meeting will be its first since Chairman Jerome Powell unveiled a policy shift towards greater inflation tolerance, effectively pledging to keep rates low for longer. Speculators trimmed net short dollar positions for the second straight week to $32.67 billion, according to Reuters calculations and Commodity Futures Trading Commission data. That’s off nine-year highs of $33.68 billion in late August. Analysts at Standard Chartered said there was a risk the Fed would disappoint dollar bears.

The data showed net euro longs inched higher but remained off record highs touched a few weeks ago. The single currency had spiked to a one-week high above $1.191 after Thursday’s European Central Bank meeting before easing back as policymakers talked it down the next day. It was up around $1.186 on Monday. The yen meanwhile rose 0.13% to around 105.9 yen to the dollar, a five-day high. The Bank of Japan’s meeting on Thursday is not expected to yield any policy changes but it may be quizzed on whether it could follow the Fed’s inflation stance.

Dollar resumes retreat as equity market mood lifts, Fed in view, Reuters, Sep 14