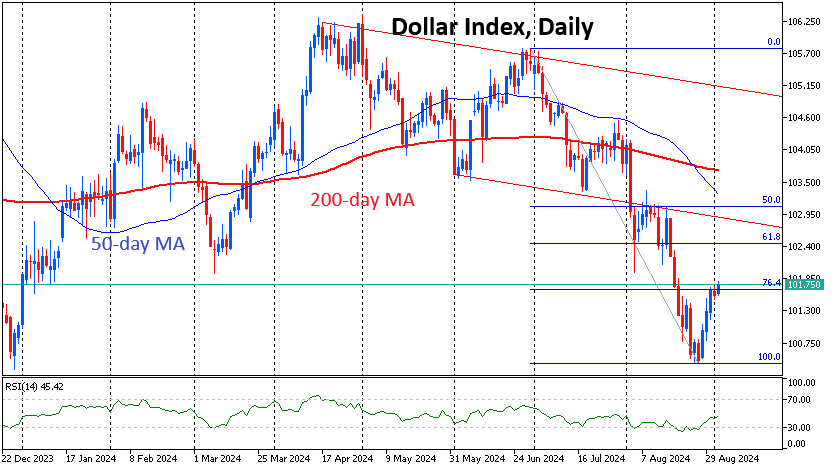

The US dollar’s recovery continues, and other markets are starting to notice. The dollar index is up 1.4% to 101.7, having found support twice in the first half of last week before falling to 101.4.

The bounce has seen the dollar recover a quarter of the anti-rally from its peak in late July to the lows late last month. The momentum around current levels could be significant as the first retracement level (76.4% of the initial move) is centred here. At this point, there is more evidence to suggest that the dollar will at least attempt a higher rebound.

A 61.8% pullback is considered a classic market correction, which, in this case, is at 102.45. The fundamental driver of the dollar’s rally in recent days has been a repricing of the odds of a 50-point Fed rate cut in September. The odds of such an outcome are now estimated at 30%, down from 85% on 5 August (and 100% at the peak of the intraday sell-off).

The recent bounce is also telling, as the dollar bulls have managed to keep the market above the 200-week moving average and the RSI out of the oversold zone on the weekly chart. This looks like the start of a deeper bounce beyond the short-term shakeout.

Some uncertainty may remain until the release of the NFP later this week or even the inflation data on 11 September. Weakness in the macroeconomic data these days has the potential to send the dollar lower again after the chances of a sharp Fed reversal have risen.

However, in our baseline data scenario, which is in line with expectations, we see the odds of a regular 25-point rate cut in September and two more cuts before the end of the year rising. This seems like positive news for the dollar, which could gain around 1% from current levels.

The DXY’s rally may not stop there and could take it to the upper boundary of the 100.5-106.0 sideways range, where it has mostly traded since the beginning of the year.

The FxPro Analyst Team