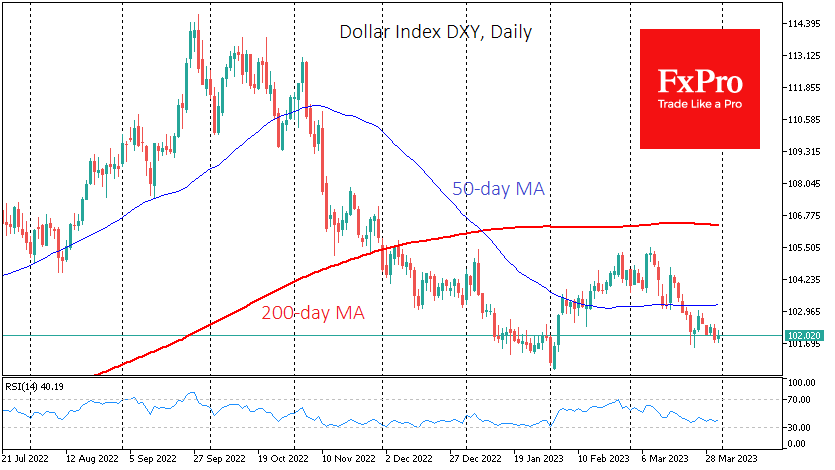

The dollar index is ending with a decline for the fourth of the last five weeks, almost completely erasing the gains from February’s rise. Although it cannot be ruled out that the quarterly portfolio shakeout will create traction in the Dollar, it is still more likely that the US currency will fall further in the coming quarters.

We consider the sharp reversal of the Dollar from rising to falling at the end of September a turning point. Before that, the DXY had been gaining following an increasingly tight monetary policy stance by the Fed. But after last September’s meeting, hopes of an imminent end to tightening loomed on the horizon for financial markets.

The link between the Dollar and Fed policy expectations has become even closer this year. In January, the Dollar was accelerating its fall as markets were banking on a rate cut even before the end of the year. There was a sharp reversal in February when high inflation put a 50-point hike back on the FOMC agenda for March. In March, these expectations melted away with the banks.

The banks’ problems are tightening financial conditions as rates do, according to Powell at a press conference on 22 March. This was a hint that further rate rises are not guaranteed.

In contrast, other regions may need to continue their crusade for inflation, thereby reducing the spreads of debt securities yields.

This is a typical story in the currency market, with the Fed at the forefront of the monetary cycle, which initially forms 12-18 months of dollar growth on rate hikes, but then triggers a move in the opposite direction. In the last six months, we have seen the quite typical and understandable reversal of the Dollar.

Last year, the rise in the Dollar also helped with inflation, bringing the expected policy reversal closer to easing. However, now it is the turn of other developed country currencies, where central banks will try to tighten financial conditions to suppress inflation.

We also see the beauty of the technical picture in the Dollar. Thanks to the rise in February, the oversold nature of the Dollar has been removed. That said, on the weekly timeframes, the DXY rebound in March lost strength on the approach to the 50-week average, leaving it within a long-term bearish trend.

If we are right, the immediate downside target looks to be the area of the year’s low at 100.7 on the DXY against the current 102. A consolidation below that level would cause the Dollar to stare into the abyss, where there is only minor technical support in the area of the 90.00 level.

The FxPro Analyst Team