The onslaught of the Dollar is affecting more and more currencies and commodity assets. Perhaps the most striking exception to this trend, however, is Oil. Stock indices show mixed dynamics, but we still urge caution on the stock market’s near-term prospects, even though equities received support at the beginning of the month.

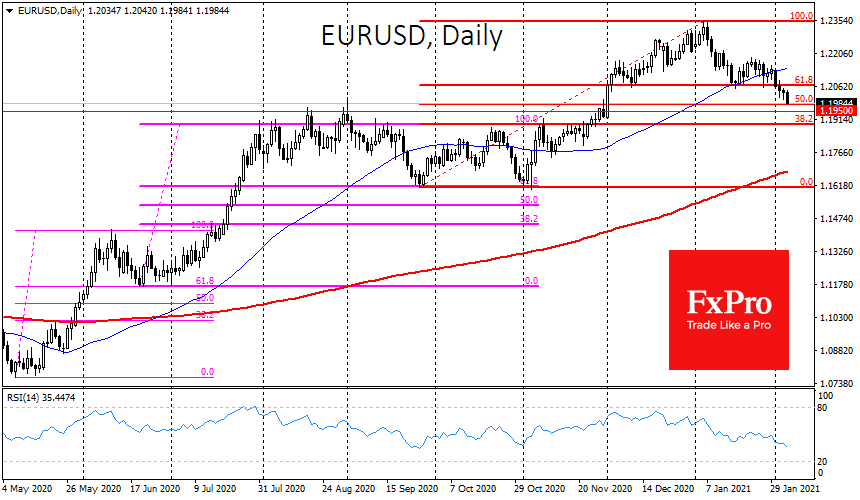

EURUSD has declined for the fourth consecutive trading session, undermining buyers’ strength near the 1.2000 level. The pair lost about half of its gains from November to early January. Bearish pressure has become more methodical after EURUSD slipped under the 50-day moving average. With no significant technical barriers, the pair runs the risk of testing the support at 1.1930-1.1950 this week. A break below these levels will cause many market participants to doubt that the US debt problems will trigger the USD’s multi-year weakening.

Nevertheless, we still see the US currency’s recovery as something of a market breather: technically, the Dollar has been heavily oversold, demanding a reset of shorts. The Dollar demand is also justified by primary dealers preparing for large-scale Treasury auctions in the coming weeks. These actions will “wipe” trillions of dollars from the market at once, and it will take months for the Fed printing press to restore market equilibrium.

We have already seen the euro’s rise breaking while the Yen and Franc strengthening against the Dollar were broken earlier this year. Yesterday the British Pound joined several currencies where the dollar bulls have also managed to break the trend. GBPUSD broke the uptrend support line and sank out of this channel.

The Pound falling from the uptrend channel could be a rush by the sellers, as the Bank of England meeting is on the agenda today. No interest rate changes or changes in the size of the QE program are expected. However, it is worth looking at the other Central Banks’ actions recently. The ECB and RBA have announced extensions to their asset purchase programs. In contrast, the Bank of Japan has lifted its cap on its yield management program’s size.

A move towards more easing or an extension of the asset purchase program has the potential to increase pressure on the Pound, justifying its fall out of the upward channel since September 2020.

The FxPro Analyst Team