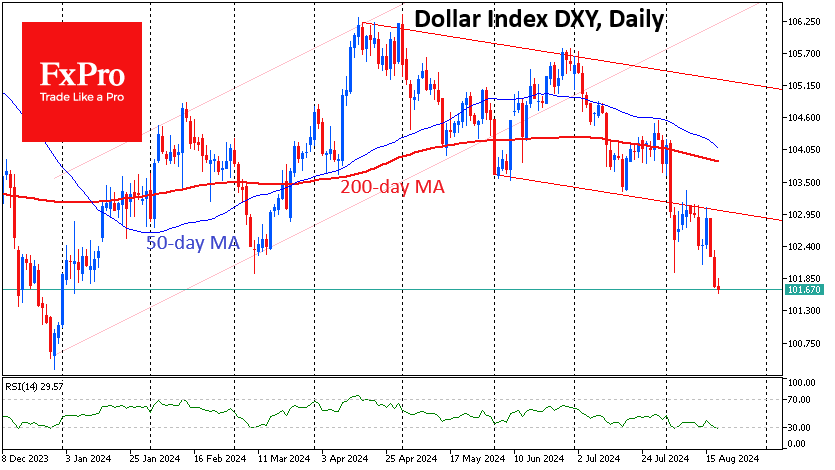

The US dollar has fallen to its lowest levels of the year, losing more than 2.3% from its August peak and around 4% since early July as expectations of a Fed rate cut in September began to be priced in.

The dollar index has retreated to 101.7, reflecting growing expectations of Fed easing. Although the ECB and the banks of Canada, England and New Zealand have already begun their easing cycle, the currency market historically reacts first to changes in US monetary policy and then to others.

Expectations of looser Fed policy in the coming quarters are also undermining the dollar’s position. In the first half of the year, the prevailing narrative was that lower inflation was allowing monetary policy normalisation to begin. In recent weeks, however, the narrative has shifted towards easing to stave off a recession.

The change in sentiment about the economic outlook sets the stage for further rate cuts in the coming quarters. The main scenario has a 60% probability of a cut of 100 basis points or more by the end of the year, including at least one cut of 50 basis points. This is a dramatic change from the 1.5% chance of such an outcome at the beginning of July.

From a technical perspective, the DXY Dollar Index is now near the lower end of its range from early 2023. This range doesn’t have a clear bottom, but dollar reversals to the upside from this point over the past 20 months have triggered corrections in equities, although they haven’t broken the bull market.

Technically, Powell could save the dollar at his Jackson Hole symposium later this week. However, there is an equal chance that his dovish tone, which observers are waiting for, will give the dollar carte blanche to weaken further and break long-term support.

In a bearish scenario, the next important milestone on the way down will be the 99.2-100.4 area (July and December 2023 lows), and the final target could be a pullback to the 90-92.6 area.

If Powell strips the markets of their illusions of a 100-point rate cut by the end of the year, with relatively neutral employment data and inflation at 3% (still above target), it will bring buyers back into the dollar. In such a scenario, we could see the DXY move back towards the upper end of the last two years’ range (106.2-107.0) before the end of the year.

The FxPro Analyst Team