The S&P500 and Nasdaq100 indices staged a solid intraday rebound yesterday, digesting the initial drop and closing the day higher. Along with the rebound in equities, a reversal to the downside is forming in the Dollar Index.

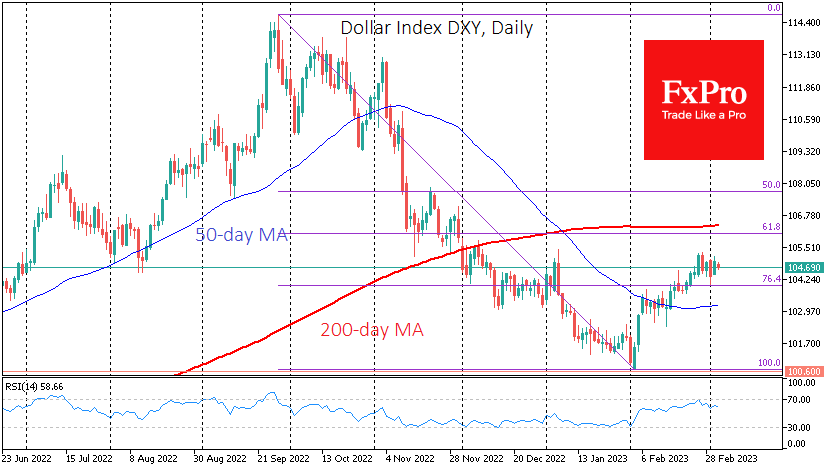

Technically, the dollar’s rebound in February has cleared the oversold conditions accumulated during the decline since late September last year. The RSI on the daily timeframe touched the overbought territory and was turned down precisely a week ago, leaving room for further declines.

Strictly speaking, the pullback is below 61.8% of the initial decline that passes through the 106 level. Below that is the 200 SMA, but the USD bulls didn’t have enough power to push the American currency into the area now, as in January. The 105 territory is interesting, as it has seen several reversals in the past.

A possible intermediate target for the US currency is 103.2, the 50-day average. Also, here, the DXY stopped rising in March 2020. It is very likely that the dollar will continue its slide at this level and will test the February lows of 100.6 before the end of April.

The view that the dollar is weakening against its major rivals fits well with historical examples. Often the Fed is the first to tighten monetary policy, triggering a wave of dollar strength. But a few months later, other central banks followed suit or moved ahead of the Fed.

Compared with January, the bond markets have priced in the Fed’s expectations quite well. In turn, the ECB and the Bank of England continue to push up expectations in their markets. As in previous similar episodes, this reassessment of expectations by the Fed’s “competitors” promises to be a driving force in the currency markets.

The picture in EURUSD and GBPUSD is also bullish, as the pairs received strong support from buyers on dips to psychological and technical levels near 1.05 and 1.20, respectively.

The FxPro Analyst Team