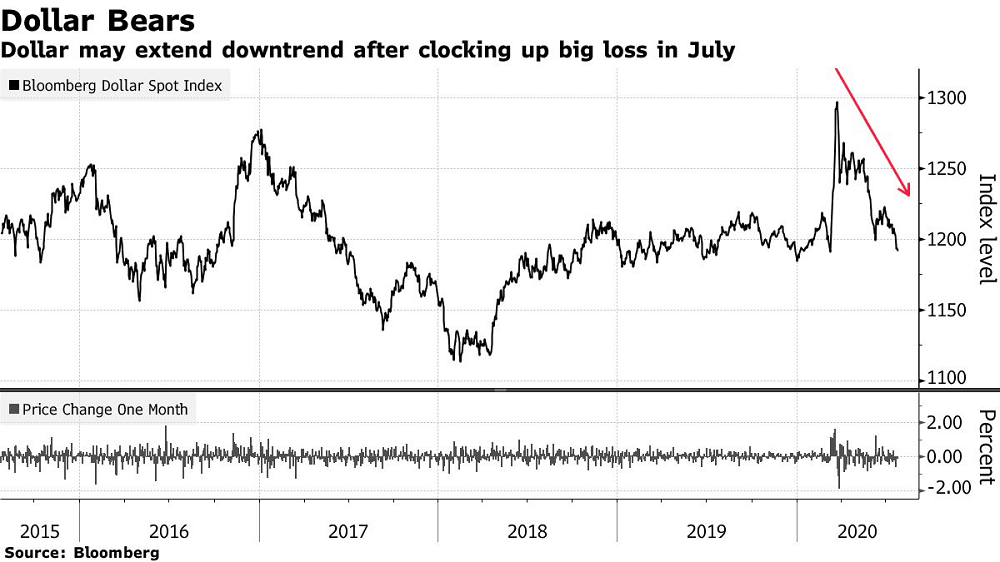

After rocketing higher in March as the ultimate haven currency, the dollar is now headed for its worst month since the beginning of 2018, and many strategists see the sell-off continuing. Negative real rates in the U.S., the relentless spread of the coronavirus in America and a pickup in global risk sentiment have seen investors hitting the eject button on long positions in the greenback.

With the Bloomberg Dollar Spot Index already down 2.3% in July and the yield on five-year Treasuries dropping further to an all-time low at 0.2548% Friday, here is why strategists say the greenback has fallen, and where they think it will go from here:

Royal Bank of Canada

The S&P 500 index rising above a key double top technical level signals further losses to come for the dollar, given that short-term correlations between stocks and the U.S. Dollar Index are at their most negative since 2016, according to George Davis, chief technical analyst. Recovering commodity prices also weigh on the greenback as the correlation between the two moved to the most negative in over two years.

Wells Fargo

The dollar is likely to decline after next week’s meeting of the Federal Open Market Committee, even as policy is expected to remain unchanged, according to strategists including Mike Schumacher. While a slight pickup in U.S. Treasury yields might cap gains against the yen and emerging markets, the euro and “dollar bloc” currencies are expected to benefit.

Bank of America

Bank of America strategists have raised their year-end target for the euro versus the dollar to $1.08 from $1.05. “The key driver of a weaker USD remains buoyant risk appetite and the U.S. equity market specifically,” wrote strategists including Ben Randol and Athanasios Vamvakidis. Despite this, they retained an overall positive view on the greenback, based on the negative outlook for the global economy.

Dollar Is Losing Its Luster as Investors Line Up to Go Short, Bloomberg, Jul 24