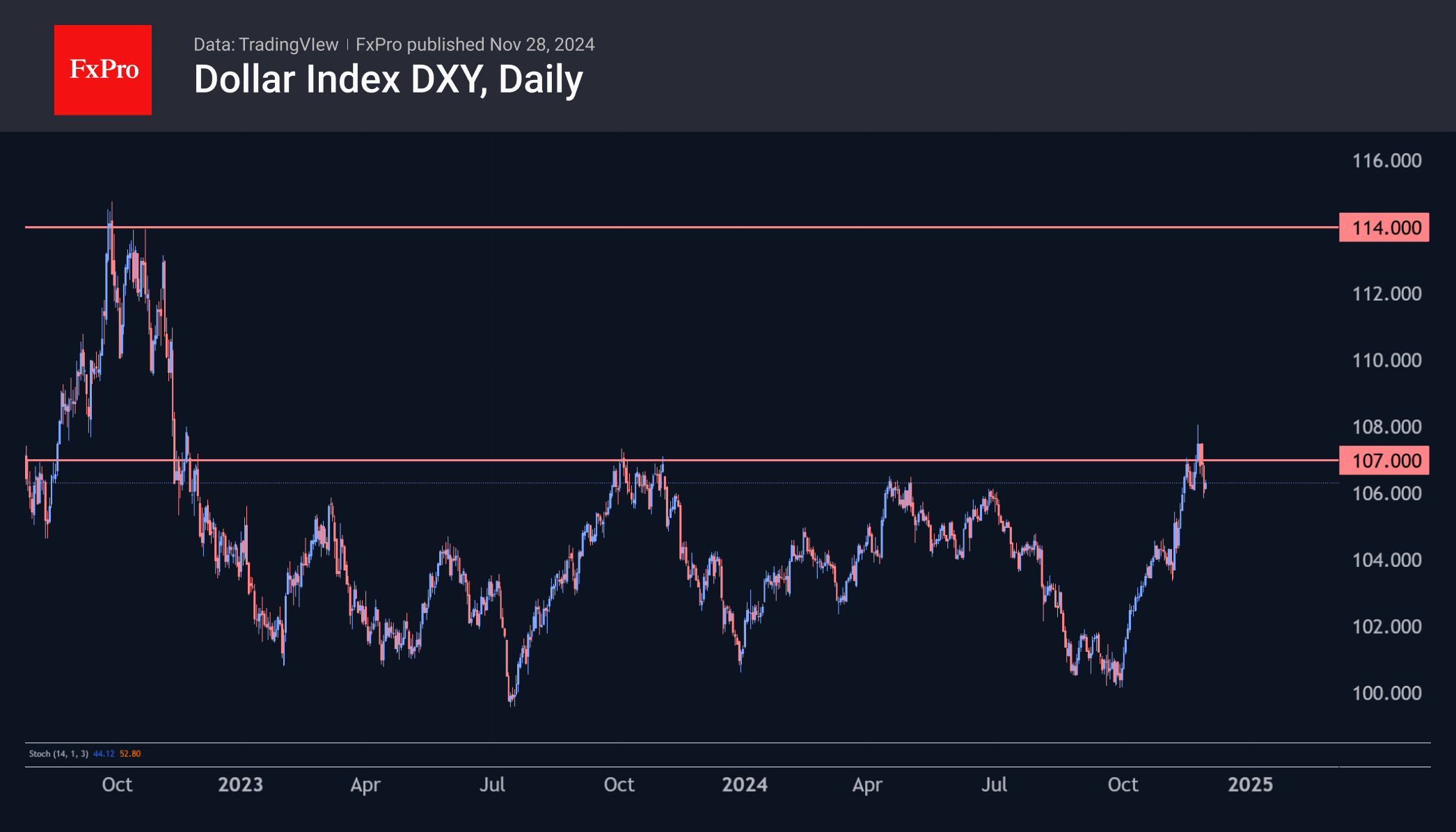

The dollar index fell last week after hitting a two-year high. The fundamental reason for the move was the ceasefire between Lebanon and Israel. Technically, it appeared as a corrective pullback after testing the upper boundary of the two-year trading range.

At one point, the Dollar Index crossed the correction threshold to 61.8% of the rally since Trump’s victory and 76.4% of the total Trump rally since the lows in late September. The dollar’s situation resembles a tactical retreat ahead of a fresh attack on the highs.

The bullish view is supported by the Fed’s shift towards a less hawkish stance. The US central bank, followed by the markets, is revising its expectations for rate cuts next year. At one point during the week, the main scenario was that rates would be left unchanged in December. By the end of the week, however, the odds of such an outcome had fallen back to 30%.

Nonetheless, we remain cautious about the acceleration in US household income growth to 0.6% month-over-month in October, with spending growth at 0.4%. Both indicators suggest that consumer demand remains healthy. The pending home sales index increased by 5.4% year-over-year, marking the highest level since May 2021.

The core personal consumption expenditure price index accelerated to 2.8% year-over-year from lows of 2.5% in June and July. This indicates a new wave of growth. What should be of particular concern to the Fed is that this rise is driven by higher inflation in the services sector, which is not easily contained.

The FxPro Analyst Team