The Dollar Index rallied for the fourth day in a row, gaining over 1.7%. Thanks to a mix of geopolitics and shifting expectations for the Fed’s next move, the dollar bounced solidly off the 100-point low on the DXY. After the decline, the dollar came close to testing the key medium-term 50-day moving average and the upper boundary of the consolidation range. The release of employment data may determine the Dollar’s direction in the coming weeks.

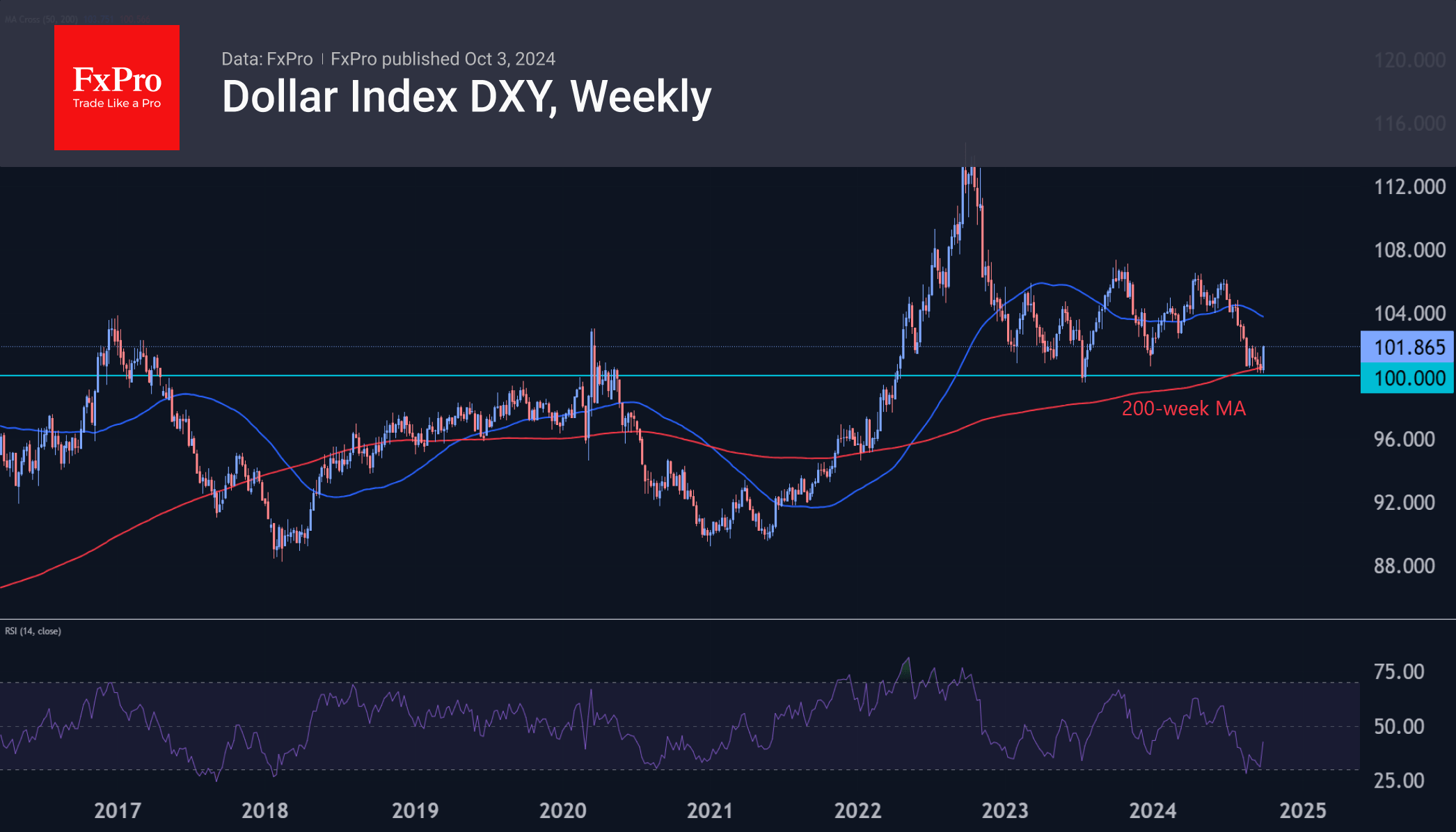

The Dollar Index has been supported since the beginning of the week after touching the 100 area, a round level that has been a support since the beginning of 2023. This time around, the importance of this area has been reinforced by the fact that the 200-week moving average, which defines multi-year trends in the currency market, passes through it.

The bulls are also encouraged by the divergence between the price and the RSI, where a lower low in the price coincided with a higher low in the index. In addition, the price rose from oversold territory, indicating that the downward momentum has been exhausted.

Technically, upside potential has formed on the weekly chart from the current 101.9 to 104 (50-week) or 106-107 (area of the last 12-month highs). A break below 100 opens downside potential to multi-year lows around 89-90.

On a lower – daily – timeframe, the DXY has climbed to the 50-day moving average and the pivot point from the first half of September. The Dollar has thus approached resistance, having exhausted the potential for a small bounce. Although the price may cross technical levels intraday, a close above 102 for the day, or better still for the week, is a reliable signal.

For further gains, the Dollar will need a driver in the form of a change in expectations for the economy and monetary policy. The closest such driver is Friday’s US employment report. Among the indirect indicators, we will be looking for a jump in the number of job openings in August and an increase in private sector employment according to the ADP estimate of 143K in September, up from 103K previously.

Later on Thursday, weekly estimates for jobless claims and the ISM services index will be released, while nonfarm payrolls are due on Friday. After the decisive rate cut in September, the Fed is paying more attention to the labour market than to inflation. Signs that the economy is slipping into recession will trigger a fresh wave of dollar weakness, while strong data will suggest a wave of dollar growth rather than a short-term bounce.

The FxPro Analyst Team