US inflation data put pressure on the dollar yesterday. The short-term charts clearly show that after a brief bear attack with an attempt to sink EURUSD below 1.1900, the pair experienced an impressive surge up to 1.1940. A couple of hours later, the buying became more measured, gradually taking the key forex pair to 1.1970 where it is currently.

The US Consumer Price Index rose stronger than expected, marking an acceleration to 2.6% y/y of overall inflation and 1.6% y/y ex food and energy. Much of the increase is attributable to a low base effect as prices fell by 0.4% in March 2020. The base will be even lower next month after it lost 0.8% in April 2020.

But the base effect is not the only driver, as since November, the rate of price increases has picked up due to increased economic activity. People are buying more, travelling more, visiting restaurants and booking hotels.

But at the same time, the Fed continues to reassure the markets that it will not rush to tighten policy. The combination of high inflation and low rates is eating away at the dollar’s purchasing power, forming speculative short-term pressure on it.

Interestingly, the news on inflation has not caused long-term bond yields to rise. And this is good news for growth companies, widely represented in the Nasdaq. As a result, we see the index updating historical highs and going above 14000.

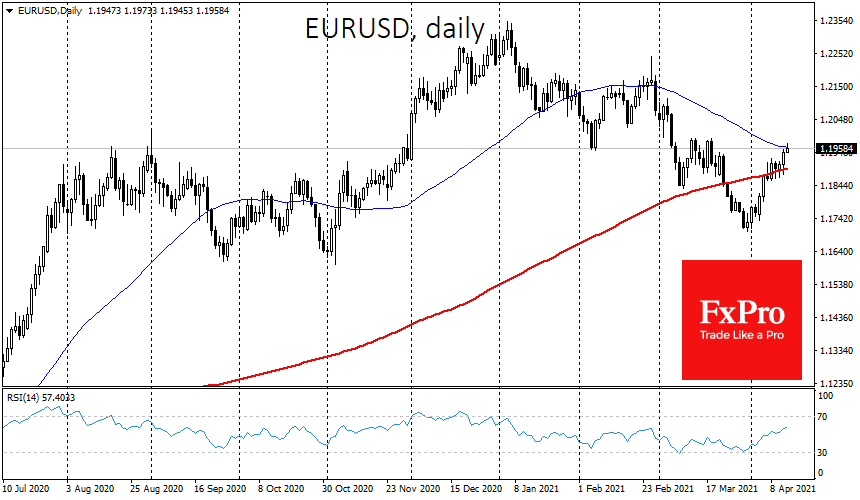

From the technical analysis perspective, yesterday’s move could be a retreat of the dollar bulls, validating EURUSD’s return above the 200-day average. The pair may move upwards in the coming days due to the upward crossing of this line.

The Dollar Index has a reversed story. It falls faster after a failed attempt to stay above the 200-day average, paving the way for more losses.

Additionally, a cross of the 50 SMA (EURUSD bottom-up, DXY top-down) might cement the dollar’s reversal. Recent extremums look like potential targets for the latest momentum. No significant technical support is visible for the DXY up to the 89.20-89.70 levels. For EURUSD, the nearest resistance is seen only at 1.2170 and further down to 1.2350.

The FxPro Analyst Team