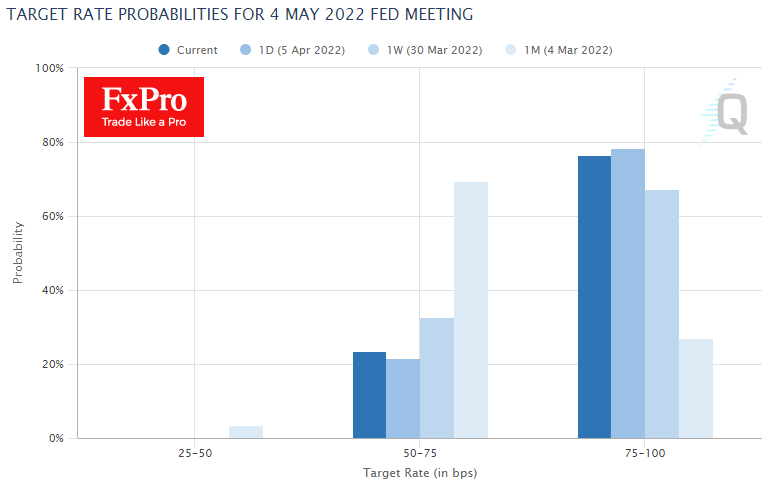

The dollar is rising against most of its major rivals on the latest hawkish comments from the Fed. The futures market lays a 77% chance of a 50-point rate hike at the next meeting in a month from 27% a month ago.

FOMC member Lael Brainard said yesterday that she expects a combination of balance sheet cuts and rate hikes to make Fed policy more neutral later this year. Although no 50-point hike follows directly from those words, markets are paying attention to the tightening of rhetoric rather than the Fed trying to cool the panic around inflation as it did last year.

A breeding ground for a new wave of dollar strength is being created in this environment. On Wednesday morning, the dollar index to a basket of FX’s six most popular currencies hit new highs in May 2020, climbing to 99.7. Rising US bond yields in response to a more hawkish Fed tilt feed interest in dollar assets with more attractive yields.

Separately, investors are “voting” for America against Europe because of the economic outlook. The imposition of sanctions, injury to business, and supply chain disruptions are affecting prices and materially shrinking the economy. This situation leads to monetary policy in the Eurozone promising to remain more accommodative for the foreseeable future to maintain growth and reduce the debt servicing costs of governments.

High inflation increases the tolerance of the US Federal Reserve and the Treasury for a rising dollar. Policies now support the competitiveness of US exports, and a stronger dollar will help curb rising import prices.

With such inputs, we should not be surprised if EURUSD rewrites the March lows in the coming days, dropping below 1.0800 and then diving further in search of a bottom until the end of the year with the potential for declines as low as 1.04-1.05.

The FxPro Analyst Team