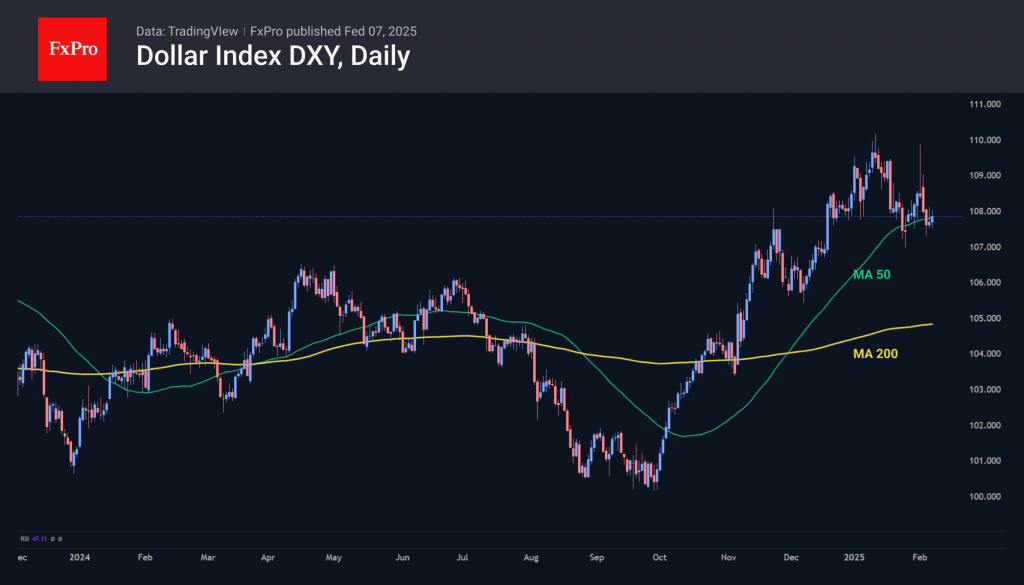

The dollar commenced the week with a 1% increase against the Dollar Index, briefly reaching mid-January highs. However, unlike gold, it did not achieve a breakout. Instead, the dollar depreciated in the first half of the week, swiftly returning to its 50-day moving average.

US labour market data provided mixed signals, showing an unexpectedly weak rise in new jobs, yet a decline in the unemployment rate and a continued 4.1% year-over-year growth rate in average hourly earnings.

We are closely monitoring the dollar, as its challenges in appreciating this year may indicate an impending reversal. Nevertheless, it is premature to assert a break in the uptrend since the DXY has not breached the 50-day moving average and remains within a typical correction. Furthermore, fundamental factors such as Federal Reserve policy and robust macroeconomic data continue to support the US currency.