The weakness of the US dollar and rumours of the Fed resuming asset purchases have been catalysts for gold’s rise since the beginning of the week, but Thursday and Friday clearly showed that this is no longer a one-way street. In 2011, gold reached a record high thanks to quantitative easing programmes.

Since the beginning of 2025, the precious metal has risen 60% and is on track for its second-best annual gain in history after 1979. Buying on dips and key central bank rate cuts this year are forms of monetary stimulus. They lead to falling Treasury yields and a weaker US dollar. This environment is favourable for gold.

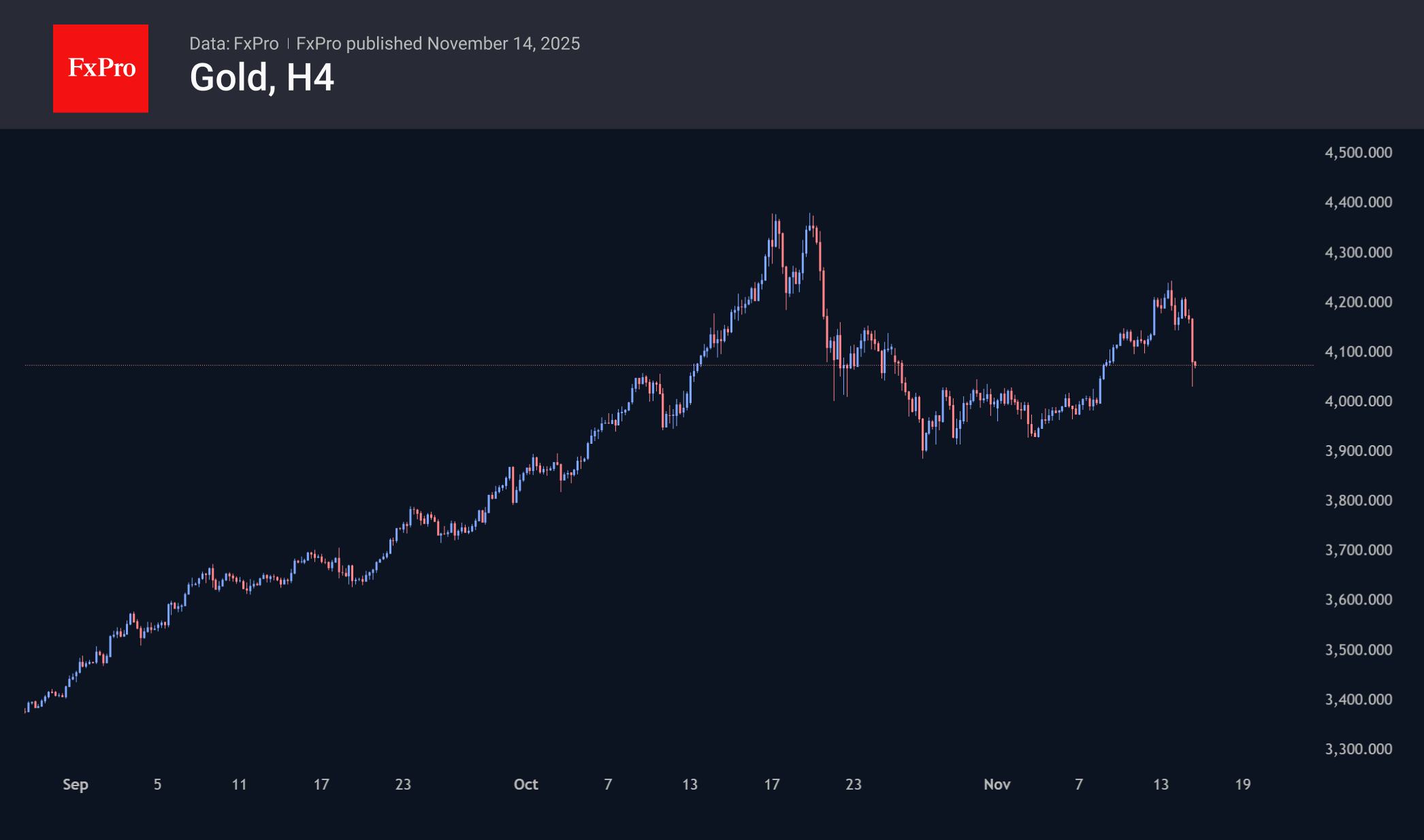

On the other hand, there is a growing impression that the markets have had their fill of gold and other precious metals. Since the end of last month, gold has been selling off heavily after its rise, which appears to be an attempt by bears to demonstrate that they have broken the bulls’ back.

Gold, like other risky assets, was undermined at the end of the week by a sharp decline in the chances of a Fed rate cut in December. If FOMC members really nudge the market in this direction, the dollar is doomed to rise and gold to fall. However, we still see higher risks that the data coming out of the US will show a sharp deterioration in the economic landscape. In this case, we should expect the dollar to rise and a flight from risk, but in such cases, gold soars in the early stages, only to fall off a cliff later on.

The FxPro Analyst Team