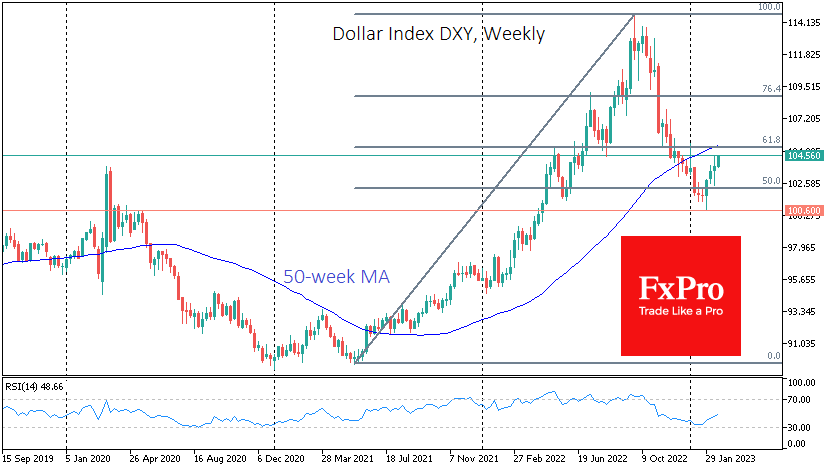

The Dollar Index has risen 3.8% to 104.5 from its lows in early February. Prior to that, the dollar index had been falling since late September, giving back half of the gains from the global rally triggered by the Fed’s sharp monetary tightening.

Although the dollar’s decline in recent months has been deeper than a typical Fibonacci retracement, this move looks like a profound correction within an uptrend. Early this month, the Dollar got support on the decline to the 100 area, a significant round level that acted as almost impregnable resistance in the pandemic. This time it proved to be no less solid support.

In addition, the dollar looked oversold, which provided initial support in early February. However, the US currency’s momentum against its rivals no longer looks like a technical fluctuation but rather a deliberate buying of dollar-denominated securities.

The fundamental reason for buying the US currency is the strong macroeconomic data, with inflation still alarmingly high, which should strengthen the central bank’s will to tighten. Judging by the tone of officials’ comments, the Fed is ready to do so.

The minutes of the last meeting showed that FOMC members felt that a 25-basis point hike was appropriate but that they were prepared to consider a sharper hike if needed. Even with the standard step, the Fed intends to stop tightening policy later than the markets have been expecting in recent months, which has helped to boost equities.

The long-term bullish trend in the dollar suggests that the DXY will return to multi-year highs near 115 by the end of this year.

Even without taking such a global view, the near-term outlook for the dollar remains bullish. Since the beginning of the week, the rally has taken the corrective pullback to a new level. A consolidation of the DXY above 104 opens the way to 106, a retreat to 61.8% of the last four months’ failure after failing to reverse downside resistance at 76.4% of that move. There is a 200-day moving average of 106. We will unlikely see a real bull-and-bear battle for the USD until these levels.

The FxPro Analyst Team