By the start of trading in Europe on Wednesday, EURUSD is trading around 1.1900 after briefly touching 1.2000. The dollar received double support on Tuesday, reversing down after just two minutes held above the psychologically important level at 1.2000, and further benefiting from a strong manufacturing activity report.

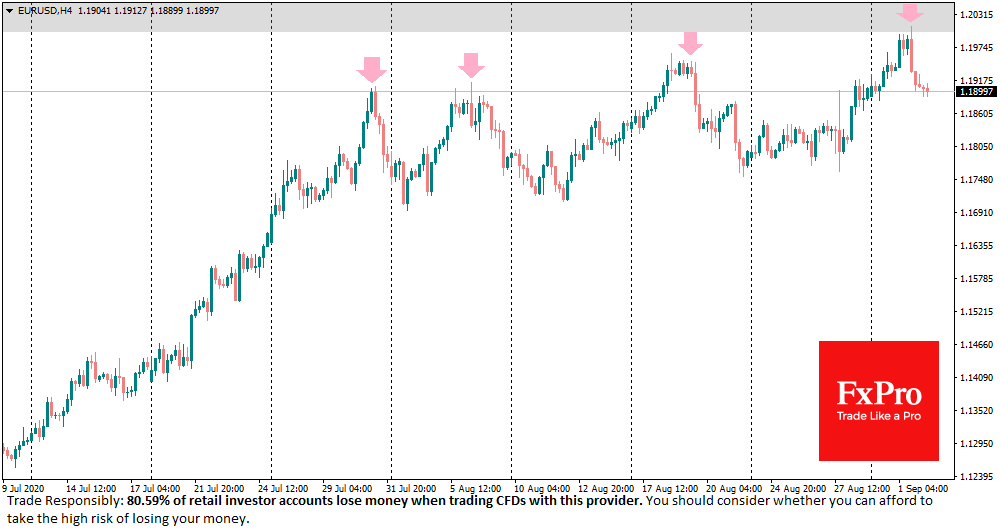

This is not the first time since late July that we have seen EURUSD strongly fall following the renewal of its two-year high. So far, there have been four such advances, that temporary thrust the pair down by about two figures, or about 1.7%. However, the dollar is yet to develop a strong growth momentum, and each time dollar bulls counterattack from higher levels.

Yesterday’s pullback is only half of its expected path, becoming tuned for a possible continuation of downward momentum in the coming days. This is supported by signals from the Relative Strength Index indicator. While EURUSD is reaching ever higher local highs, the RSI peaks are becoming lower. This performance often acts as a precursor of a deeper correction or a change to a downtrend.

Macroeconomic data have recently assisted the dollar. The published ISM Manufacturing Index showed unexpectedly strong growth from 54.2 to 56.0 and much better than expected 54.6. Among the components of the index, a jump in new orders received a positive response. It is also worth paying attention to the increasing price pressure.

The employment component, on the other hand, notes a further decrease, pointing to additional optimisation of the labour market and prompting us to anticipate with caution the employment data on Friday. As manufacturing contributes less than 10% to GDP, compared 70%+ of the service sector, the recovery in services and construction can easily overshadow a slight reduction in manufacturing.

The dollar received its support at the right time. Suppose the labour market on Friday confirms signals of rising inflationary pressures and a recovery in employment. In that case, this could be the basis for a deeper recovery of the dollar beyond the 1-2% short-term correction.

A drop for EURUSD below 1.1750 could be a confirmation of serious intention of the dollar bulls. However, this level is significantly far from current market quotes.

The FxPro Analyst Team