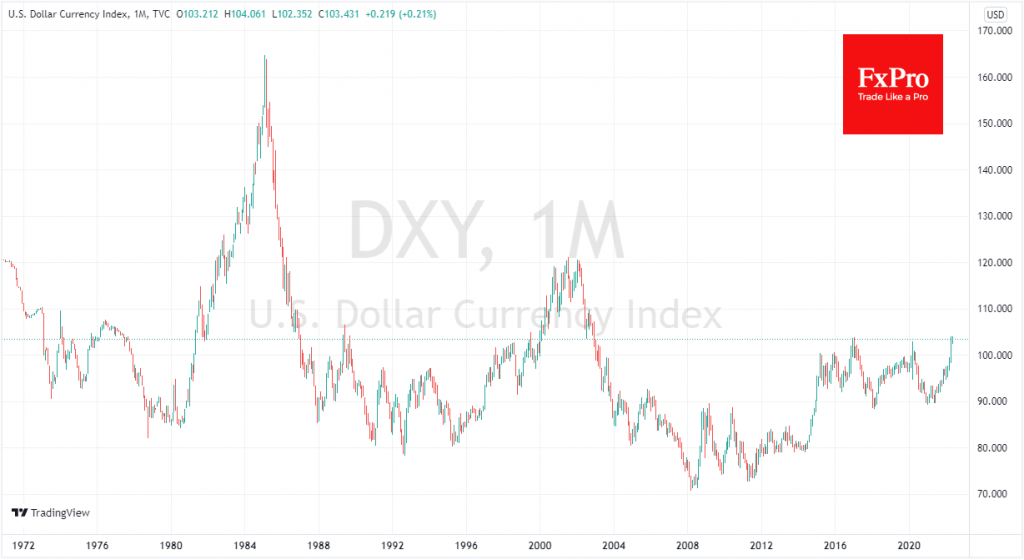

The dollar index renewed its highs in almost 20 years, surpassing 104, as crucial US currency rivals one by one lost buyer support.

Suddenly the dollar was a safe haven of last resort. In 2018 and 2020, the dollar was approaching current extremes amid a total sell-off in equities and commodities. But in those years, flight to safety forced demand for the yen and franc, which is not the case this time as both ‘havens’ are at multi-year lows with equity markets falling.

The Dollar Index has been testing the upper end of its trading range for the last six years, and it now has a much higher chance of holding above that level. The previous two times the DXY got close to 104, the economy and inflation needed stimulus, not cooling as they do now.

This is a sharp reversal in attitude to the dollar, which in 2021 was often described as losing its value and leading currency status. While its relevance as a means of payment continues to be debated and questioned, its increasing rate, coupled with more attractive US government bond yields, makes the dollar an almost uncompromising choice at the moment.

European or Japanese politicians can hardly be expected to be complacent about the depreciation of their currencies, further fuelling inflation and exacerbating economic problems.

The Japanese authorities seem to have successfully talked the markets down at the end of April by stopping the yen’s decline near 130. Over the last couple of days, we have seen an intensification of policymakers and economic institutions from Continental Europe, indicating the need to raise rates soon to match the pace of tightening from the Fed.

At current levels, the dollar has found itself in a zone of turbulence, which clearly shows the scope for the GBPUSD to fluctuate over the last 24 hours. A consolidation above 104 at the end of the week would confirm to markets that the next technical stop for the DXY could be around 120, which is the high of the early part of this century.

The FxPro Analyst Team